Chartered accountancy is becoming a popular career choice worldwide, thanks to the growth of global trade and the need for skilled accountants in complex financial systems. More and more jobs are being created for qualified chartered accountants who want to succeed in the financial world.

There are various options to be a chartered accountant, with many courses provided by universities to enable you to study accounting. Two of the most popular options are the ACCA (Association of Chartered Certified Accountants) qualification and the CA (Chartered Accountant) course.

One significant benefit of an ACCA qualification is that it’s known globally, so you can work across various countries. If you are looking at finance as a career and can not make up your mind between taking an ACCA qualification and a CA course, this blog will enlighten you as to why taking ACCA could be more advantageous for you.

What is the ACCA Qualification?

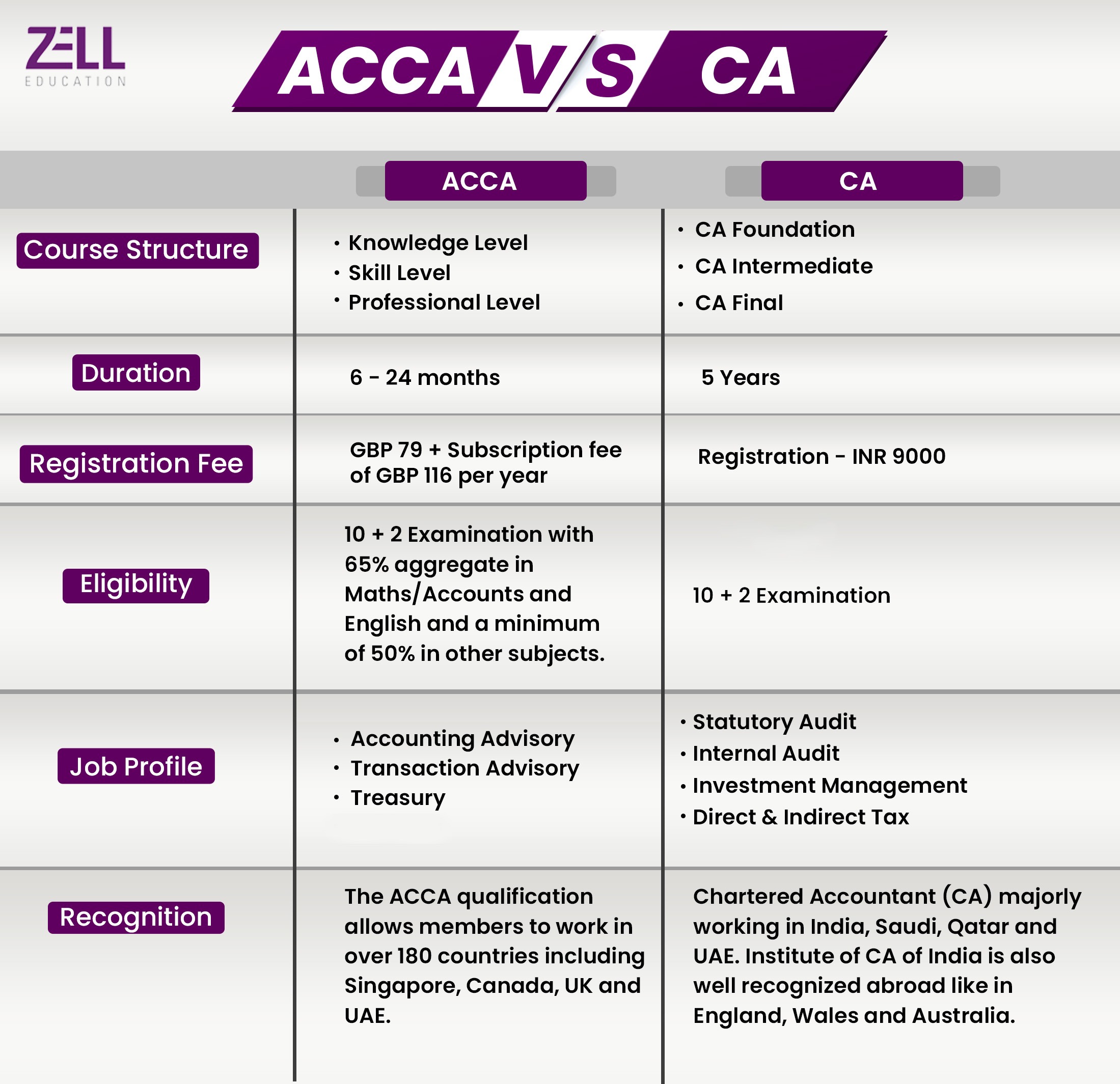

You can earn ACCA certification through three levels of examinations – Applied Knowledge, Applied Skills, and Strategic Professional, along with completing the Professional Ethics Module. By following these rules, you can become eligible to take ACCA examinations.

- Complete at least high school (12th grade)

- Get at least 65% in Accounting or Mathematics, and English in your high school exams

- Score at least 50% in other subjects in your high school exams

If you have only completed 10th grade, you can still apply for the ACCA course through the Foundation in Accountancy (FIA) program.

The ACCA exams are held four times a year: in March, June, September, and December.

ACCA Exam Stages

The ACCA certification is divided into three stages:

- Applied Knowledge

- Applied Skills

- Strategic Professional

The Applied Knowledge module consists of 3 papers, and the Applied Skills module has 6 papers, adding up to a total of 9 papers in the Fundamental Level of the ACCA exam.

At the Professional Level, there are two types of subjects:

- Essentials: Papers P1, P2, and P3

- Optionals: The other three papers

To earn the ACCA qualification, candidates also need to complete the Professional Ethics Module.

Passing Criteria:

To pass the ACCA exams, you need to:

- Pass all the papers

- Score at least 50% on each paper

- Out of the four optional papers, only two need to be passed

What is Chartered Accountancy?

In the U.S., Chartered Accountancy is similar to becoming a Certified Public Accountant (CPA). In India, the Institute of Chartered Accountants of India (ICAI) certifies individuals as Chartered Accountants after passing three levels of exams:

- CA Foundation

- CA Intermediate

- CA Final

CA certification is extremely popular in India, but it can be used primarily within India. What this implies is that workers who are certified by ICAI cannot work outside the nation unless they also hold other certifications. Nevertheless, Chartered Accountants in India enjoy good career progression and handsome salaries since they are in demand by Indian organizations.

How is ACCA Better Than CA?

ACCA and CA are both good options to create a career in accounting. Yet, pursuing ACCA following CA can prove to be more advantageous. Owing to the Mutual Recognition Agreement (MRA) between ACCA, which is the UK’s accounting body, and ICAI, India’s accounting body, Indian CAs can get internationally recognized by pursuing the ACCA course. This can lead to numerous other employment opportunities and assist CAs in developing their careers. Below are the best reasons why you might want to pursue ACCA following CA:

1. ACCA is Recognized Around the World

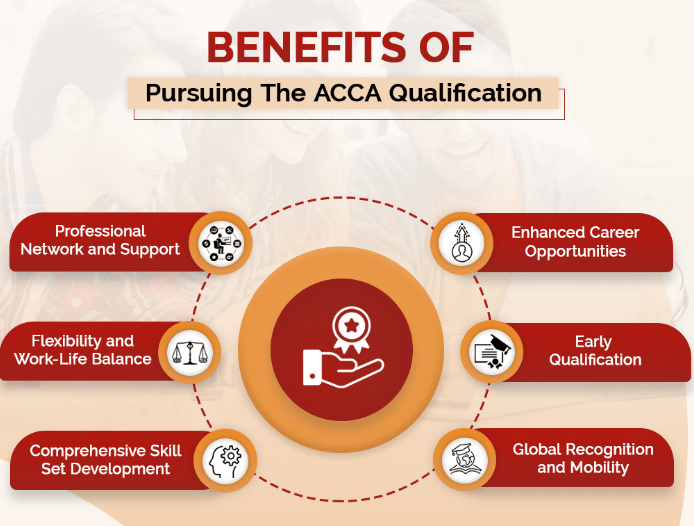

The ACCA is a worldwide organization with more than 2 million students and members in 170 nations. An ACCA qualification is valued by employers across the world, so you will find it simpler to secure a job anywhere. On the contrary, CA professionals may only work at companies that recruit Indian CAs in India, in most cases. With ACCA being recognized by more than 180 countries in the world, ACCA-qualified professionals may work anywhere, like the UK, UAE, Singapore, etc.

2. Access Career Opportunities at Senior Positions Worldwide

The global economy is changing at a rapid rate, and it has a bearing on career prospects and the skill set one needs for leadership roles. ACCA allows you to gain the advanced-level financial skills and innovative thinking needed for leadership and strategy roles across the world.

After completing CA, if you gain an ACCA qualification, it opens up many career opportunities. ACCA professionals may work in various industries such as advisory services, public and nonprofit sectors, corporate finance, and more.

Some of the job roles for which ACCA professionals are hired include banking, auditing, risk management, insolvency, taxation, forensic accounting, etc. Here is a list of some of the typical job roles that are held by ACCA professionals. With the qualification of ACCA, you can search for senior roles in areas like:

- Financial Performance Reporting

- Corporate Audit & Assurance

- International Taxation

- Legal Compliance

- Risk and Control Evaluation

- Management Reporting for Different Stakeholders

- Strategic Alliances (Mergers and Acquisitions)

- Business/Financial Analysis

3. Learn International Financial Laws

ACCA helps you learn about financial and taxation laws in countries like the UK and the US. This global approach gives you a wider range of knowledge. In contrast, CA focuses mainly on the financial rules of the country where the course is taken, which can limit your career options abroad.

4. ACCA Takes Less Time to Complete

You can finish the ACCA qualification in less time compared to the CA. For example, you can attempt 8 out of the 18 papers required for ACCA in one year. With CA, it can take years to pass all the exams and become a certified chartered accountant.

5. ACCA Has a Higher Pass Rate

ACCA exams carry a much higher pass percentage than CA exams. The pass percentage of ACCA is around 40-50%, while the pass percentage of CA is much lower, around 4-5%. This suggests that it can be easier to clear ACCA exams even if you are not very certain about all topics.

6. Get in Touch with the Global Network

ACCA supports over 219,000 members and 527,000 students across 179 jurisdictions in the world to build flourishing business and accountancy careers with skills in high demand from employers. ACCA has a network of offices all over the world and over 7,500 approved employers globally.

ACCA’s global partnerships also make it easier for members to follow international regulations and work wherever they want. Plus, ACCA has agreements with several well-known global accountancy organizations, making it even easier for you to work around the world.

7. Only 4 Papers with High Passing Percentages

Chartered Accountants are exempt from 9 papers and can start directly at the professional level. The ACCA program is very flexible, allowing you to choose how you want to study, how often you want to take exams, and where you gain practical experience.

Usually, Chartered Accountants take about 6 to 8 months to complete their professional exams, but this depends on how many papers you take in each exam window.

8. Become “Future Skills” Ready to Stay Relevant

As technology continues to advance, most of the simple tasks, such as producing reports, reporting data, and transaction processing, are being substituted with more sophisticated leadership and management roles. To remain current, you must acquire good problem-solving and analytical skills.

Moreover, decision-making in a global environment that takes account of various stakeholders is a necessity in today’s strategic leadership. The ACCA qualification equips you with the skills through a global curriculum and case study-based exams to prepare you for innovative and future-driven jobs.

9. Meet the Changing Expectations of the Best Employers Worldwide

With the evolution of the world of finance, employers are seeking workers with a variety of skills. Emerging career fields now demand cross-country experience and the capacity to learn in various fields, instead of pursuing a single, specialized career.

The ACCA syllabus mirrors these developments by providing case study exams that demonstrate real-world issues. The course format is designed to encourage you to think in innovative, multifunctional terms so you are ready to answer dynamic business questions and seize stimulating new challenges.

Conclusion

If you have already completed your CA and want to do ACCA, it can be much quicker because you can get exemptions from at least 5 ACCA exam papers. Choosing the best ACCA coaching will help you completely prepare for the exam.

Pursuing ACCA is an excellent choice for those who seek a career in accounting, particularly if you plan to work overseas. It is perhaps easier than CA, but not quite. If you need better chances of passing the exams, you have the option of depending on internet sources or sitting for a preparatory course. Sitting for one of the courses will allow you to pass your ACCA exams and begin your accountancy career on the correct footing.