Having money nowadays is not as it used to be a few years ago. All of it is brought about by technology, and you no longer need to sit in the office of a financial planner to plan for your future. You can now employ the services of AI investment advisors, which are advanced computer programs that invest on your behalf.

Meanwhile, there are still human financial planners offering personal advice and emotional counsel when things become too intricate.

Do you trust AI advisors or rely on human planners? Let’s simplify it.

What Are AI Investment Advisors?

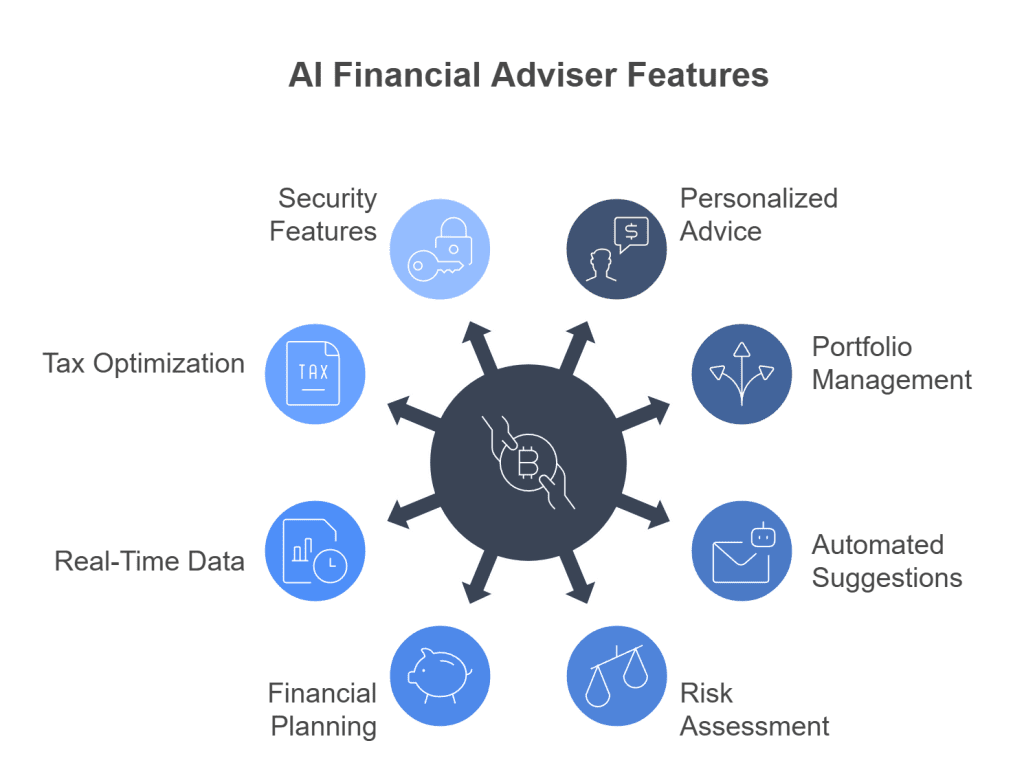

AI investment advisers, or robo-advisers, are intelligent web-based platforms that employ artificial intelligence to guide your investments. Rather than working on a human, such platforms collaborate with high-level algorithms that learn your goals, risk tolerance, and time horizon. From this information, they create and rebalance your investment portfolio for you.

In simple terms, they are a 24/7 smart helper to your money, no long meetings, no paperwork, just fact-based choices.

Benefits of AI Advisors in 2025

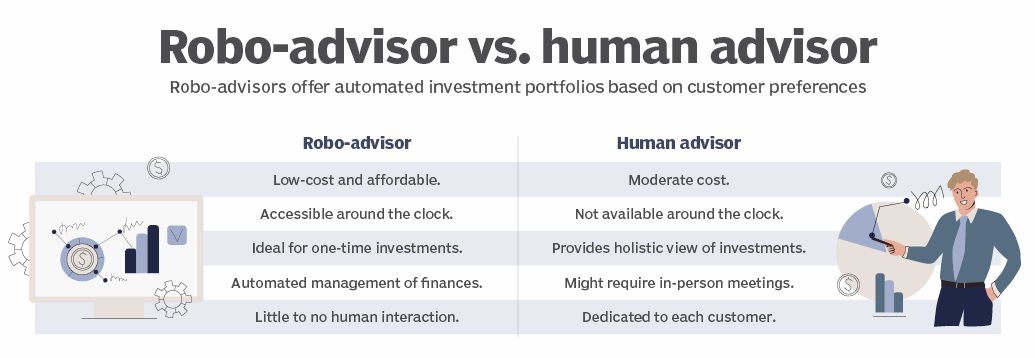

- Cheaper: AI planners are also less expensive than human planners. They will ask you a fee that is usually between 0.25% and 0.50% of the money you invest, which is very reasonable even for a newcomer.

- Always Available: They are online, and as such, you can log in at any time to check your portfolio or get immediate advice without necessarily booking an appointment.

- Quick Smart Decisions: They scan enormous amounts of market data rapidly and make quick, unbiased investment choices.

But AI is not perfect. It can perform only what you tell it to perform. It cannot understand things like marriage, loss of a job, or an emergency arising at home. AI does not offer emotional support, which is what most people need when the market crashes or when they have to make hard financial choices.

Why Human Financial Planners Still Matter

Whereas AI is wonderful for efficiency and low expenses, human financial advisors provide something technology can not, and that is empathy and personal connection.

A solid financial advisor does not simply do math. They will listen to your history, understand your emotions, and create agendas that will connect with your aspirations in life. They also make adjustments in case of a significant event, such as planning for retirement, children, or older parents.

Benefits of Human Advisors

- Human Interaction: Personalized financial plans are developed by human planning associates based on your specific circumstances, like values and goals.

- Emotional Guiding: They will relieve your stress when there is a downturn and will not commit emotional mistakes.

- Expert Knowledge: They do more than investments, providing assistance with tax planning, estate planning, business succession, and more.

Of course, there is a price to pay. Human advisors usually charge 1% to 2% of what you invest, which is pricier than AI. They can even require a greater minimum investment. On top of that, you will typically need to book meetings rather than receive instant advice.

Cost and Accessibility: AI Wins Here

One of the largest reasons individuals choose AI advisors is the affordability. AI investment advisors typically cost between 0.25% to 0.50% of the money that you invest. Some even lack a minimum balance, which is ideal if you are new to investing or simply do not wish to invest a huge amount of money.

Human consultants, however, cost more. They tend to charge 1% to 2% or even more, and most will require you to have a bigger investment amount just to be able to work with them in the first place. And besides, you normally have to schedule appointments to meet them, which is less convenient than AI apps that are accessible 24/7.

The Future is AI + Human Partnership.

In 2025, the wisest financial approach is not between AI and humans, but combining both of them. AI (artificial intelligence) excels at performing repetitive tasks, scanning lots of data in a short time, and making instant updates. Human financial planners excel when they establish trust, provide emotional guidance, and create sophisticated plans that require a personal touch.

Finance experts concur that AI will continue to dominate with speed and precision. But human wisdom will always remain crucial for customized financial achievement. Imagine this: AI-driven platforms lay a solid foundation, and human advisors provide care, comprehension, and long-term planning.

Advice for Selecting the Best AI Advisor in 2025

Some easy things to consider before deciding:

- Know Your Needs: You can get AI advisors to do simple or middle-ground investments. However, at higher-order financial planning, like retirement, taxes, or inheritance, a human advisor may be preferred.

- Check the Cost: AI advisors typically have lower fees, while human advisors might be pricier.

- Consider Access: AI operates 24/7 without appointments necessary. Human advisors might only be accessible during designated times.

- Take into Account Trust and Ease: If you prefer face-to-face guidance and need someone to offer personalized guidance, a human advisor may provide you with greater confidence.

Conclusion

Both AI investment advisors and human planners will have their own advantages by 2025. AI makes investing simpler, quicker, and more cost-effective, while humans provide empathy, personal attention, and specialist planning.

So, whom do you choose? The answer is based on your financial objectives, budget, and the type of support you want.

For most, the ideal is a combination of both, with AI taking care of the numbers and data and humans bringing wisdom and guidance. Together, this makes wiser, more compassionate wealth management.

The best part is that in this new generation, all, from beginners to professional investors, have the kind of assistance they need. Whether you opt for AI, human, or a combination of both, do not forget what matters most: your financial growth, relief, and long-term success in 2025 and later.