Buying your first home is actually an exciting experience, yet it may be a bit overwhelming, too. Two of the things any first-time homebuyer in the USA should be well aware of are LTV (Loan-to-Value) and the deposit. These help in establishing the sum of money needed as a deposit and the sum that can be borrowed at the bank. I will break this guide down into easy words so that you will be at ease when buying a home.

What Is LTV (Loan-to-Value)?

LTV stands for Loan-to-Value. The percentage is what shows how much of what you would like to borrow of the price of the house you are paying in the form of a deposit.

Here is an easy way to understand it:

Imagine a house costs $250,000. You have saved $50,000 for the deposit. That means you will need to borrow the remaining $200,000 as a mortgage from the bank.

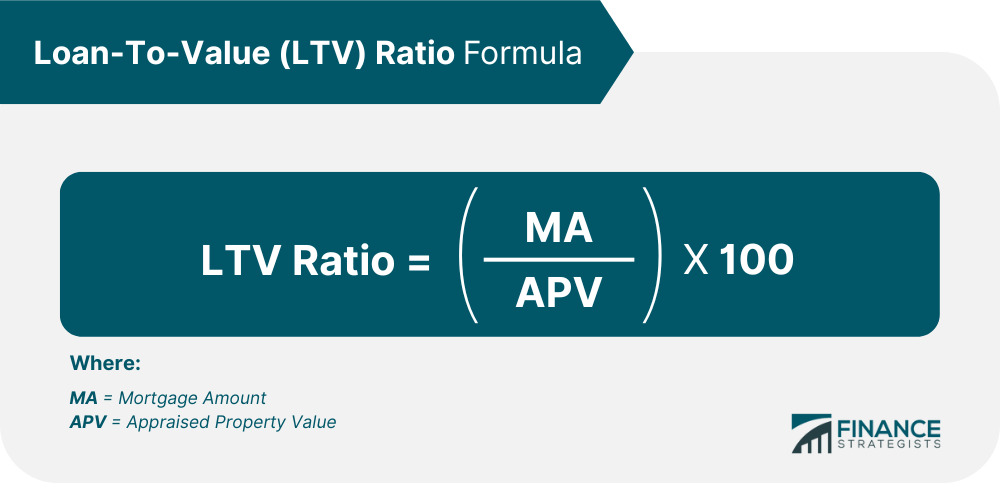

To calculate LTV:

- Divide the loan amount ($200,000) by the home price ($250,000).

→ $200,000 ÷ $250,000 = 0.8

- Multiply by 100 to turn it into a percentage.

→ 0.8 × 100 = 80%

So, your LTV is 80%. That means you are borrowing 80% of the home’s price and putting down 20% as your deposit.

Why Is LTV Important?

Lenders estimate the risk of lending you a mortgage based on Loan-to-Value (LTV). The larger your LTV, the larger your loan relative to the value of the house.

This is how it works:

Low LTV (60%–70%) → The more the deposit, the less the risk, and, in most circumstances, the more competitive the mortgage interest rates.

High LTV (90%–95%) → Low deposit, greater risk, and often high interest charges or extras.

How Much Deposit Do First-Time Buyers Need?

When you buy your first home, you will have to save a deposit. In the US, the majority of first-time homebuyers pay between 5 and 20% of the price of a house.

Here is a simple breakdown:

- 5% Deposit → LTV of 95%. This is the minimum some lenders allow for first-time buyers.

- 10% Deposit → LTV of 90%. With this, you may get lower mortgage rates.

- 20% Deposit → LTV of 80%. This is the sweet spot for the best mortgage deals since lenders see you as low risk.

Different Types of Loans and LTV Terms

Not all mortgages come with the same LTV and deposit terms. These are the most common ones:

- FHA Loans: Ideal for low and moderate-income homebuyers. The loans allow a 96.5% LTV, so you only need to make a 3.5% down payment. The trap is, however, that you will pay mortgage insurance in the long run.

- VA Loans: For military men and veterans, VA loans can offer 100% LTV, or no down payment at all. But you may need to pay some extra fees.

- Conventional Loans: These are normal mortgages. Typically, they take down payments between 5 and 20%, depending on the lender’s LTV.

- USDA Loans: 100% LTV is also available to rural purchasers of USDA loans. But there are strict eligibility requirements that they must meet.

Choosing the right kind of loan can save you a huge sum of money and make it easy to buy your home.

How LTV Affects Interest on Your Mortgage

Your LTV ratio is an important factor that determines the interest rate of your mortgage. The lower your LTV, the better the terms. This means:

- Lower monthly payments.

- Less overall money paid out in the long run.

When your deposit is big, and the LTV is low, the lenders will like to lend you less interest and not require insurance on the mortgage. This helps the lender when you fail to pay off the loan.

The bad news is not all bad. Once your LTV drops to 80% or less, you can usually switch off the insurance and save.

First-Time Buyer Tips on Managing Deposits and LTV

Here are some smart strategies for first-time buyers:

- Save as much as you can: Even reducing your deposit from 5% to 10% will get you improved rates.

- Look at government programs: There are often first-time buyer schemes in states that reduce the amount you need to deposit.

- Optimise your credit score: An improved score will secure you better interest rates, even on a low deposit.

- Shop around lenders: Lenders and banks have varying requirements for deposits, LTV caps, and interest rates.

- Get pre-approved: This will inform you of your budget prior to home hunting.

What happens to Your Deposit when You Buy a Home?

When you make an offer on a home and your offer is accepted, your deposit is placed into an insured legal account to begin showing that you are committed to buying.

- Before contracts are signed: If the sale does not work out, you can usually get your deposit back.

- Once contracts are signed: Your deposit is now part of your last payment. But if you withdraw without good reason, you could lose it to the vendor.

This is why you must understand your contract and have a solicitor or advisor.

Conclusion

Buying your first American house takes preparation, especially in terms of deposits and LTV. LTV is the proportion of the cost of the house you are borrowing to your deposit. The larger your upfront savings, the lower your LTV and the greater your mortgage deals.

Fortunately, you have a number of loan programs and government schemes that can allow you to purchase with a lower down payment. All that you have to do is take a closer look at your credit rating, shop around by taking offers with various lenders, and consult with a professional before you put your signature on the dotted line.

By proper preparation, you will surely be able to get on top of the property ladder and realize your dream of having your own house.