Invoices form the core of most companies but can also be a cause of stress and financial worry. Unlike companies that receive payments immediately, companies that run on invoices have to wait sometime before they get their cash. They also have to buy materials in advance before they even make any profit.

For companies such as construction companies or service providers who use plenty of materials and enormous payments, invoicing is essential. However, it has its demerits, like delayed payment periods and late-paying customers. Small businesses, Entrepreneur reveals, have $84,000 on average outstanding in bills.

Despite this fact suffocating you, there are protections to protect your company and get paid on schedule. This is how:

Clearly Indicate Payment Due Dates on Invoices

One of the most frequent errors that businesses commit is omitting payment due dates from invoices. It is so simple to think that customers will pay you by the time they are supposed to, but assumptions can cost you money. To be clear, place a particular due date on every invoice.

For instance, instead of saying “Due upon receipt,” put a fixed date, for example, “Payment due within 14 days.” This way, customers know how soon the payment is due, and you can monitor late payments better. Properly formatted invoices with express terms fosters prompt payment.

Digitize for Efficiency and Accountability

Surprisingly, the majority of firms are still utilizing paper invoices, even though electronic invoicing has so much to offer. Paper invoices are misplaced, lost in transit, or simply forgotten, and this leads to late payments.

By accepting invoices online, you can make the whole process hassle-free. Online invoicing ensures automatic reminders, improved tracking, and instant transmission. Document management firms like Datamation can facilitate document management and make digital transactions seamless. Automation also reduces the possibility of errors caused by human mistakes, resulting in delayed payments and better overall cash flow.

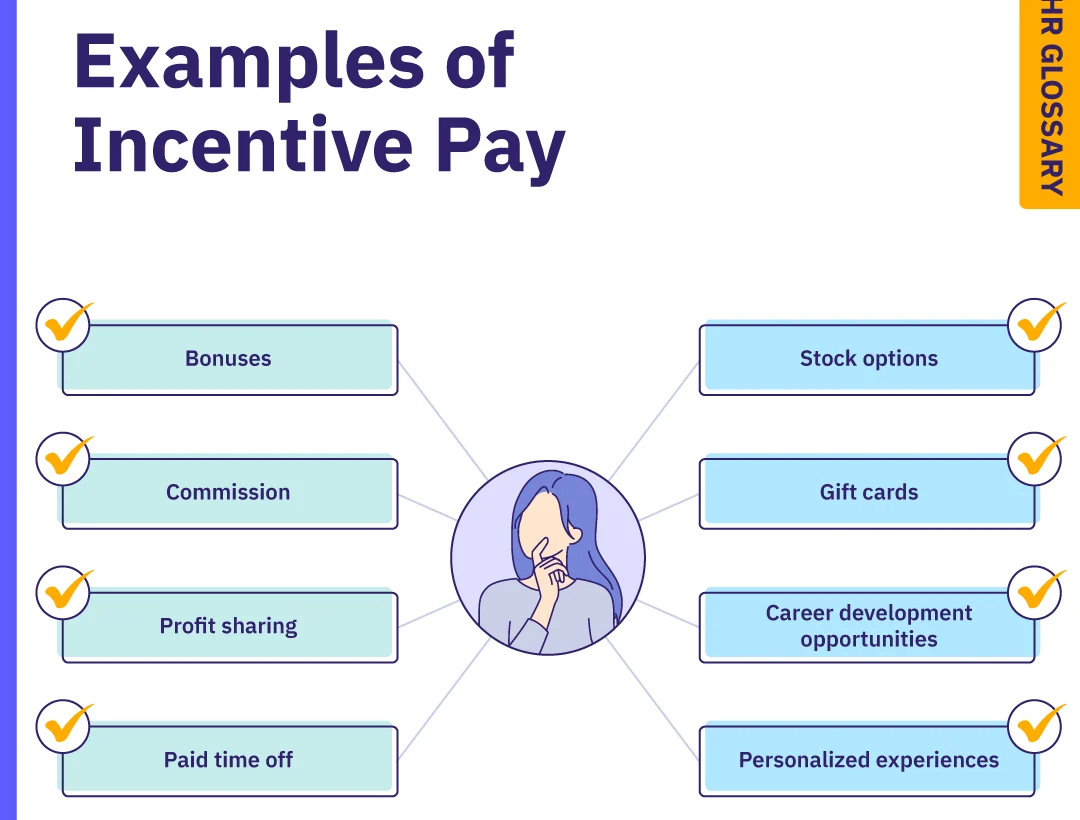

Provide Payment Incentives

It is easier to have customers pay on time if there is a payoff. Try offering discounts for prompt payments or rewards to regular customers who pay on time. You do not have to sacrifice your margins, but doing a little favor produces a lot in building loyal customers and prompt payment.

Also, charging late payment penalties can serve as a deterrent against delayed payments. Clearly outline these penalties in your terms of payment so customers know the repercussions of delayed payment. This sets expectations and promotes timely payments.

Have a Follow-Up System

Regardless of how well you publicize payment due dates, some customers will still fail to meet them. That is why it is best to have a follow-up system.

Automated email reminders or text messages can be a polite reminder of overdue clients. For a seriously overdue payment, a more forceful action—a phone call—might be necessary. In some situations, the services of a collection agency or the utilization of invoice factoring (the sale of outstanding invoices to a third party) might be the most effective means of receiving payment.

Use Invoice Insurance

For companies that have to handle frequent late payments, invoice insurance is a godsend. Also referred to as trade credit insurance, this cover protects you from not being paid even if you have a defaulting customer. This kind of policy can give you peace of mind, particularly for organizations with big invoice amounts or extended payment terms.

Demand Upfront Deposits

One of the easiest ways to avoid cash flow problems is to demand prepayment in part or in full, especially for big projects. This way, you have access to the funds to pay for materials and minimize the risk of non-payment.

Offering payment installment is a very effective technique as well. Breaking large bills into small payables makes payment simpler for your customers and yet helps maintain continuous cash inflows for your company.

Conclusion

Unpaid bills can actually wreak havoc on the bottom line of a business. But, with strict payment terms, electronic invoicing, incentives, delinquent follow-up, and even invoice insurance, you can shield your business from interrupted cash flows. By taking action now, you can reduce payment delays and keep your business financially healthy in the long term.