A small business’s ability to obtain the correct amount of finance at the right moment is critical. Small-scale manufacturing and service industries require continuing financial support to achieve their working capital needs and long-term asset purchase goals. In the USA, the primary role of banks and financial institutions is to offer appropriate credit in the form of business loans. They require financial assistance to meet their working capital and investment needs.

What Is An Unsecured Loan, And How Does It Work?

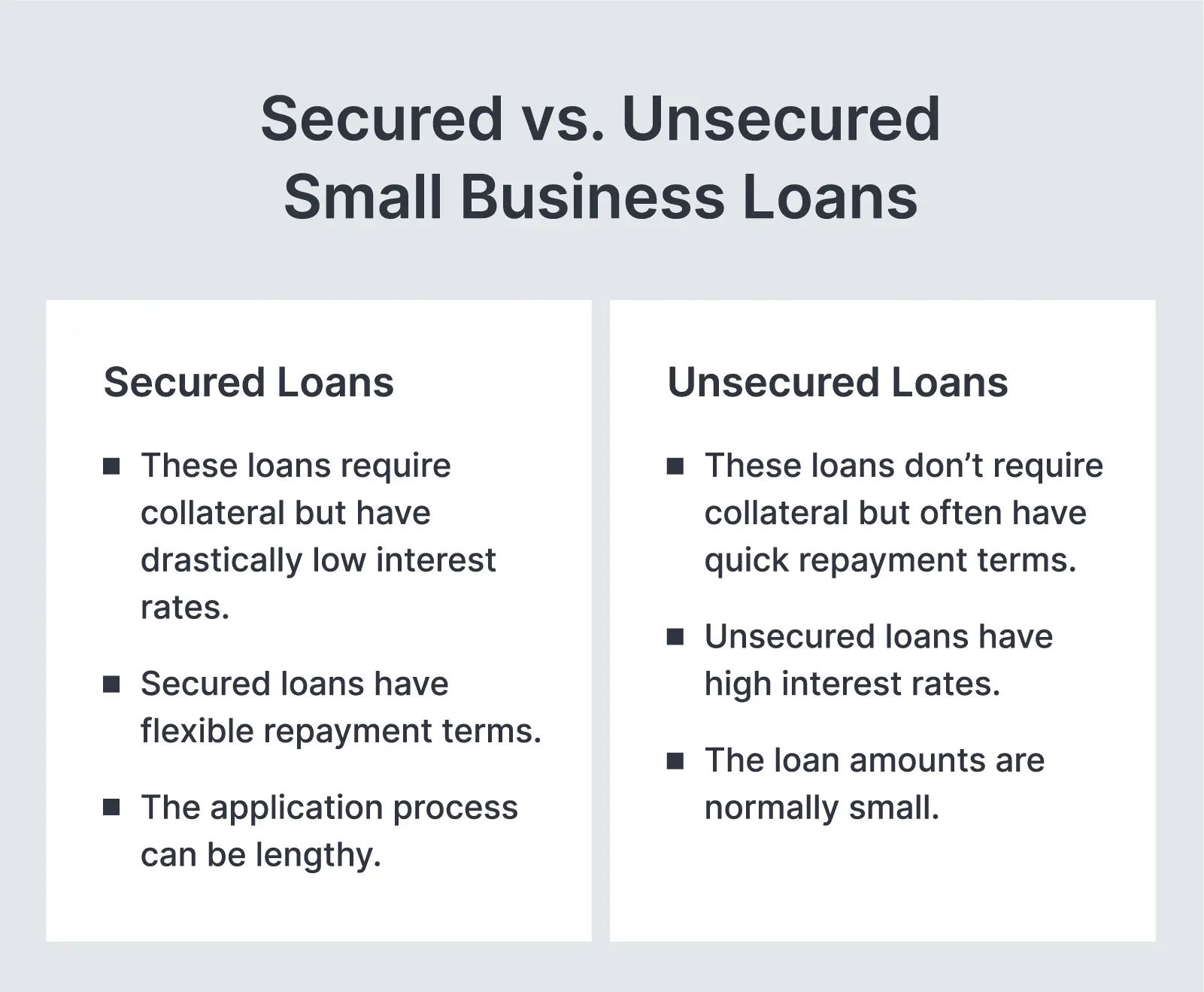

An unsecured business loan is granted only on the basis of the business borrower’s creditworthiness, as evaluated by income, financial documents, and other relevant variables. This loan does not require any collateral or guarantees.

Unsecured business loans are also more adaptable. Many small businesses and startups in the USA can benefit from these loans, which are useful for a variety of things, including business growth, equipment acquisitions, inventory management, and cash flow management.

The borrower’s risk assessment is analyzed based on factors such as revenues from a business, years in business, and the company’s financial position. More often than not, the lender asks for a personal guarantee, in which the lender has the right to recover against the owner’s personal assets in case the business does not pay its loan. It is like a legally binding contract in which, if the business defaults, the lender can take after personal assets.

Who Is Eligible for an Unsecured Loan?

Eligibility to an unsecured business loan shall depend on various factors. Generally, the following are usually considered by the lenders:

Business credit score: Even though no collateral is required, a good credit score increases the chances of approval. A credit score above 600 is generally considered ideal.

Revenue: Almost all lenders need proof of a steady flow of income by the business so that they can be sure that repayment will come without hindrances. The lender might require $10,000 or more of the revenue every month.

Time in business: Lenders need businesses that have been operational for at least six months to two years. This will allow lenders to see if the company is stable and can be financially successful.

Personal guarantee: As noted above, a lender may require a personal guarantee, especially for small businesses or start-ups with no long history of operation. This provides additional assurance for the lender.

Generally, secured business loans are relatively easier to obtain when the business has a good past, a good credit history, and a stable cash flow.

The Most Important Advantages Of Obtaining An Unsecured Loan For Your Small Business

-

There Is No Collateral

One key advantage of taking out an unsecured loan is the lack of collateral. These loans, which are approved without any security, are a huge help to small firms. They Are helpful when they are just getting started and have not yet accumulated any primary assets.

The lender may want a personal guarantee before approving you for an unsecured loan because you will not be putting up any security. It serves as your legal document, stating that if you do not return the amount, the lender has the right to seize your property.

-

Reducing The Time It Takes To Apply For A Loan

It is straightforward to apply for a business loan online because the documentation process is low and quick. The time spent appraising assets is decreased, and the distribution procedure is simpler because there is no collateral.

The application process for a business loan could take a long time. Financial institutions want to fund businesses that pay their invoices on time and pay off their debts completely.

An unsecured business loan does not require security, allowing the lender to focus on other factors, such as credit score, monthly sales, and time in business.

-

Money Can Be Used In A Variety Of Ways

You can use the money from an unsecured business loan for anything you like. Many online fast loans do not need you to state your intended use of the funds. Whether you use it to recruit more people, expand your firm, undertake R&D, or for any other reason is ultimately up to you. This gives you greater flexibility and allows you to put the money towards things you really need.

-

Appropriate For First-Time Consumers Attempting To Establish Credit

If you are a first-time applicant with no credit history, it is a terrific method to build credit. Lenders are more concerned with your company’s profitability than with your credit history. It is beneficial to small business owners that have poor or no credit.

-

Low Risk of Loss of Assets

This risk is eliminated or minimized to an extreme extent because there is no collateral. This becomes very significant for businesses with risks that are going through financial stress or uncertain markets. With a secured loan, defaulting on payments might result in the loss of a piece of equipment or property that is crucial for the business.

Unsecured loans guarantee business owners that, if things become harsh, their assets will not be taken from them immediately. This might help lower the stress level because firms can focus on expansion rather than risk losing their loan.

Application of an Unsecured Loan

Although unsecured loans have many advantages, one has to critically analyze the risks involved. The fact that unsecured loans are riskier for the giver imposes a higher interest rate on most unsecured loans, in addition to charging repayment in relatively short periods of time.

Businesses must first establish whether they have the capability to pay back the loan within the stipulated time to calculate the cost arising from the higher interest rates.

In addition, a guarantee held personally by business owners may place the owner’s personal assets at risk, even if no assets exist in the business.

If the business owner is unable to repay the loan, the lender can seize the guarantor’s personal property, which may include savings accounts, vehicles, and even homes in certain cases. Thus, the full terms and conditions of an unsecured loan need to be known before signing on.

Among these options, one may consider other loans, including various types of loans, such as secured loans, to identify the most suitable for his or her needs.

Secured loans may be the most appropriate if one has a relatively bigger business with a stable market because they will give better terms and lower interest rates, given that there is some collateral.

Conclusion

Unsecured business loans provide flexibility, rapid access, and convenience for small businesses to get the money they need to grow and also manage cash flow and other overheads. They are suitable for startups or small businesses that have not yet built up huge assets. Because no collateral is necessary, they are more expensive in terms of interest, and the owner of the business could be requested to provide a personal guarantee. Yet, for most small businesses, the benefits of fast approval times and flexible use of funds make them a great financial instrument.

Therefore, an entrepreneur must take sufficient time to reflect on his financial needs, repayment capability, and risks before opting for an unsecured loan. This will ensure accurate decision-making for longer periods of business success, coupled with reduced personal and financial exposure.