As a result of the financial influencer wave, more people feel comfortable talking about their income and helping others use their resources and skill sets to earn similarly. The elusive six-figure income is one of the most talked-about topics, but it was certainly less prevalent a while back.

A yearly salary of $100,000 or more is sometimes called “six figures.” Many professionals want this wage as they advance and accumulate experience. However, what exactly are six figures, and is that pay range even attainable?

What Is A Six-Figure Salary

What exactly does a six-figure wage entail, first of all? A six-figure wage, to put it simply, is anything that pays from over $100,000 to $999,999 annually.

These days, many businesses may provide a “package” of benefits that includes both direct and indirect pay, such as paid time off, retirement funds, insurance, and other cash-based incentives, in addition to the annual wage and other cash-based incentives.

The amount immediately paid into your bank account twice a month is only a portion of the compensation package; each form of compensation has a monetary value. Would you have considered this offer a six-figure wage package if you had received it in the previous two years? I would, without a doubt, but many others wouldn’t because of the annual wage of less than $100,000. When someone says they make six figures, they often mean their annual income before taxes.

Multiplying an individual’s hourly income by the number of hours they work each week and then adding 52 will tell you if they make six figures. Their gross yearly revenue is the end consequence.

To make six figures a year hourly, one must work eight hours a day, 40 hours a week, and earn at least $48.08 per hour.

Is Six Figures Sufficient?

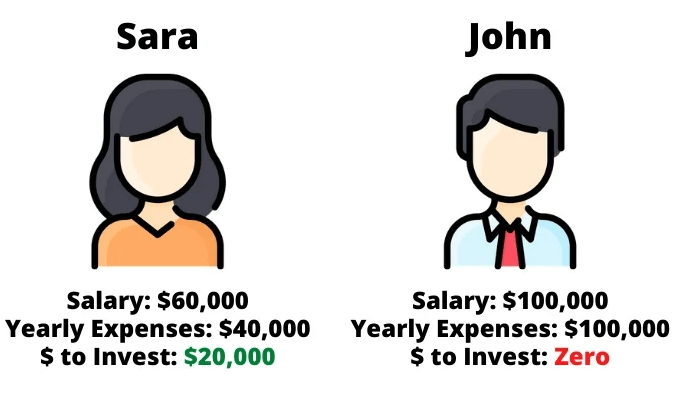

Many readers will think, “Six figures is enough, of course!” Sure, $100,000 is a lot of money, but let’s break it down again. When all your costs and taxes are taken into account, it doesn’t go as far as many people believe.

Some believe earning a six-figure income will eliminate all of their financial worries. Still, to determine if it will be sufficient to address your financial issues, you must first determine your take-home pay after taxes!

How to Earn Six Figures

- Multiple Income Streams: Try freelancing, investing, or starting a side hustle.

- Negotiate Your Worth: If you are employed, don’t hesitate to ask for a raise. Research salaries in your field to know your value.

- Skill Up: Learn new skills or specialize in a high-demand area. This can lead to better job offers or freelance gigs.

- Invest Wisely: Instead of splurging, invest your money. Stocks, rental properties, or even your own business can grow wealth.

- Start Your Own Business: Being an entrepreneur can be difficult, but it can also be quite rewarding.

- Continuous Learning: Invest in yourself by learning new skills. This can open up new opportunities.

Can Someone Without a Degree Make Six Figures?

By pursuing specific careers, one may make $100,000 or more per year without a college degree. Positions in this area may require many certifications in addition to initial and on-the-job training.

Going this way, you may also steer clear of some of the most common blunders associated with student loans, such as taking out more debt than you can afford and stalling your financial progress.

Controllers of Air Traffic

Due to their significant responsibility and attention to detail, air traffic controllers earn a high salary of around $132,250 per year. Over time, a person’s performance and background may lead to more pay.

To begin their career, air traffic controllers simply need an associate degree; this position necessitates substantial on-the-job training.

Firefighter or police officer

Depending on their expertise and area of expertise, firefighters, police officers, and detectives can earn more money. For example, the yearly wage and benefits package for police officers in California is around $117,822, which includes dental and health insurance.

Pilot for a Commercial Airline

In 2023, the median pay for commercial and airline pilots was $148,900. The first obstacle to entering this field is obtaining a pilot’s license, but it will take years to accumulate the expertise required for the most profitable jobs.

Jobs Requiring Hard Labor

Hard labor positions frequently pay exceptionally well to compensate for the high level of technical expertise and physical danger involved. The median pay for power plant operators in 2022 was $97,570. Demand and pay for these professions will almost definitely increase as energy and technology continue to gain importance in society.

Athletes and Participants in Sports

Prominent sportsmen and athletes such as LeBron James, Lionel Messi, and Naomi Osaka command multimillion-dollar annual wages; nevertheless, many of their peers make excellent salaries without having a degree. In 2022, talented athletes who received the right chances made a median wage of $94,270.

Property Broker

Salespeople and real estate brokers may make six figures without a college degree. However, they will have to spend time and money getting a real estate salesperson license, which may cost as much as $500 in California, for example, if all fees are considered.

Since commissions are the main source of revenue for real estate brokers, they must expand their clientele and acquire expertise to make six figures.

Ways To Increase Six Figures?

Congratulations! If your income is six figures or more, you are among the highest-paid individuals. Even if your salary is six figures, practicing purposeful financial management and upholding sound money practices is still critical. If you overlook this, your income may appear lower than it is.

At this point, your profits should be maximized by concentrating on skill and knowledge development, budgeting, and financial planning.

These practical money management skills will help you handle your six-figure salary effectively and maximize every dollar you make.

How Might a 6-Figure Lifestyle Appear?

If your income is six digits, you can live a significantly better lifestyle than the typical person in the country:

- Where You Live: Housing costs in certain areas, such as Honolulu, New York City, San Francisco, and Washington, D.C., almost require a six-figure wage to make ends meet. Choosing a place where the cost of living is lower might help you afford a nicer home.

- Your Medical Expenses: The rising prices of health insurance and the related medical bills for major diseases or chronic disorders are a source of frustration for many people.

- How Much Debt You Have: Even if you make six figures, it could be hard to stick to your budget if you have a lot of debt.

- The Size of Your Family: Because of added costs like daycare or assisted living care, raising children, or caring for an aged parent may result in having less money available each month.

- Your Tax Bracket: You may lower your monthly taxes and increase your take-home income by investing in retirement plans and other tax-advantaged accounts.

- Your Spending Patterns: Maintaining a lifestyle that comes with earning six figures without succumbing to lifestyle creep requires you to live within your means.

Conclusion

Getting paid six figures may be a fantastic way to financially support your family and yourself while allowing you to live comfortably.

But remember that if you want to ensure you stay within your means with a six-figure salary, budgeting, wise investment, lowering lifestyle inflation, avoiding expenditures, and future planning are crucial.

Those who have reached this milestone will be well on their path to financial independence with prudent money management.