Generally, the money you receive from income annuities and pensions is not immune to Federal tax withholding. This is the same withholding system you would experience if you received money from stock bonuses, profit-sharing, or any other type of deferred income plan. In other words, the money that you get from that annuity you purchased from your insurance company could face tax withholding if it is a regular periodic payment.

However, if this payment is sporadic or not counted as income, you do not always need to worry about withholding. In certain cases, you can choose to stop having your tax withheld. Keep in mind that this is permanent until you reverse your decision. Here is some more information about how withholding affects your annuities and pension and tax withholding tips.

Periodic Payments

Periodic payments are those stemming from your annuity or pension that last more than one year. Typically, these payments are expected to be substantial deposits that take place yearly or more frequently. For withholding purposes, funds from annuities and pensions are treated the same as a source of income. You can calculate the amount that will be withheld by examining tax guides.

Nonperiodic Payments

Unless you choose to have your wage withheld, 10% of nonperiodic payments will be removed from your total. Otherwise, you can get the full amount and deal with taxes in the new year. This applies only to annuities or pensions where you do not receive a regular payment.

Foreign Payments

If payments are made to an individual living outside the US or a residential alien inside the country, money must be withheld. You can examine your W-4P forms to understand more about mandatory withholding.

Eligible Rollover Distributions

When you have rollover distributions, these will automatically be taxed at 20% unless you choose to put the funds into a retirement account. Although there are exceptions, this rollover is the only taxable portion of a qualifying tax-sheltered program. You can examine tax guides to understand more about when these funds are taxable.

Reporting Withholding Information

You will need to report your withheld taxes when you file. They are reported on a unique withheld tax form that has options for funds from pensions and annuities. Additionally, you will be asked to provide a 1099-R with your distribution amounts.

Your annuities and pensions are subject to tax withholding. By learning more about the various factors, you can prepare yourself for dealing with this.

Essential Tax Withholding Tips You Need

Taxable Vs. Nontaxable Income

Image: financestrategists

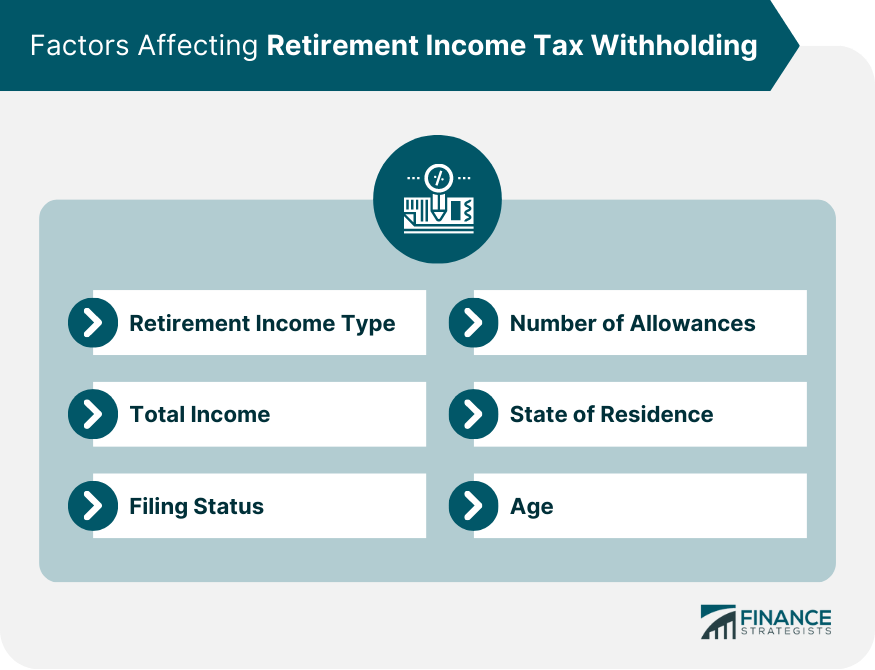

One of the ways in which managing tax obligations on pensions and annuities works is by knowing what percentage of one’s income is taxable. For instance, how you access your pension or annuity can dictate the percentage of federal and state taxes that are taken off your paychecks.

Pensions: Most distributions from employer-sponsored plans, such as most 401(k) distributions, are fully taxable. This is because, generally, the income was not taxed when contributed to the plan, so it will be taxed as ordinary income when distributed.

Annuities: If you purchased an annuity with after-tax dollars, then only the earnings portion of what you are being paid out is taxable. Whatever you paid for the annuity (your principal) is not taxable. If you buy an annuity with pre-tax money- through an IRA, for example, all of your payout may be taxable.

Knowing what portion of your pension or annuity is taxable will help you decide how much should be withheld for taxes.

When to File Form W-4P

Just like when you were employed, you may change the amount of tax withheld when you start receiving your pension or annuity. In fact, the IRS requires recipients of pension or annuity payments to file Form W-4P, wherein you can specify how much federal income tax you desire to have withheld.

On Form W-4P, you will note your filing status: single, married, etc., and how many allowances you want to claim. The number of allowances means the amount withheld on a regular basis. More allowances lower the amount withheld; fewer allowances increase it. If you do not fill out a W-4P, you could find yourself in a situation where you are not withholding enough during the tax year, leaving you with a very large check at tax time.

How to Change Your Withholding:

- If your income will change applications for extra pension payments, for example-or you are going to take a lump-sum distribution, you are going to have to amend the withholding. If you will see changes in your deductions sometime down the road, like when you pay off your mortgage or no longer have dependents, then these changes may impact your withholding, too.

- Pay special attention to your withholding when you experience a change in life status, such as marriage or divorce, to make sure that withholding adequately covers your tax liability.

Withholding on Lump-Sum Distributions

Lump sums will also be a significant tax consideration for most retirees. When you elect to receive a lump sum from a pension or annuity, the IRS will withhold 20% of the sum for federal income tax unless you roll the distribution into a qualified retirement plan, such as an IRA, within 60 days.

While 20% sounds like a lot, paying the total tax liability could easily be insufficient. In fact, actual tax depends on the level of income, and if this distribution places you in a higher tax bracket, you might owe more at tax time.

State Taxes on Pensions and Annuities

Of course, there are federal taxes to worry about, but the real variability comes in the form of state taxes on pension and annuity income. Some states, such as Florida and Texas, have no retirement income taxes, while others, like California and New York, tax pensions and annuities at a rather high rate.

There is no state pension tax in Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming. This implies that retirees living in any of these states will not have to pay state-level pension taxes, which will consequently help reduce their tax burden immensely.

Some states exempt a portion of the type of pension or retirement income made. For instance, in Illinois and Pennsylvania, exemptions only apply to specific types of pension or retirement income. In Arizona and Georgia, retirees can exclude part of their pension income from being taxed.

Prevention of Underpayment Penalties

If you take out too little in withholdings from your pension or annuity income, you may be subject to penalties for IRS underpayment. Because the IRS requires taxpayers to pay taxes on income as they earn it, withholding is very important. If you fail to withhold sufficiently or you fail to make estimated tax payments, then you may also be subject to an underpayment penalty.

Suppose you receive income from sources other than your salary-check earnings, such as Social Security benefits, rental income, or investment income. In that case, you may need to make estimated tax payments each quarter.

Tax Withholding on Foreign Pensions

Tax withholding rules for people who are pensioners who receive pensions from abroad will depend on the tax treaty of your country of origin and whether there is a tax treaty between the United States and that country. All income earned worldwide must be reported and subject to tax for U.S. citizens and resident aliens. Tax treaties, however, often relieve some tax implications or may limit double taxation.

Conclusion

Proper planning and understanding of tax withholding on pensions and annuities can really make the difference between retirement security and retirement insecurity.

Planning is the key to a worry-free retirement, and the following tips will help you maximize your pension and annuity income while minimizing tax headaches.