Starting a new business is exciting, but it also comes with many challenges. One of the most important things for any startup is making the right forecasts about money, sales, and growth. Sadly, many new businesses make forecasting mistakes that hurt their chances of survival.

In this blog, we will look at the biggest forecasting blunders that can ruin startups and how to avoid them so new founders can build strong and successful companies.

Why Is Forecasting So Important for Startups?

Forecasting is merely the determination of what is going to occur within your business in terms of finances, such as the amount of finance that will be incurred and the time when those changes will occur.

Good forecasting will assist you in planning budgets, making prudent decisions, attracting investors, and ensuring that you do not run out of funds. Alternatively, bad forecasting will lead to overspending, scaling at an undue rate, or squandering resources, any of which is deadly to your startup.

Forecasting matters because it helps startups:

- Budget plans and manage expenditure to ensure that money is not squandered.

- Make investors interested by presenting convincing and credible financial forecasts.

- Control cash flow so money is never wasted in the business.

- Establish achievable objectives and follow up to ensure that you are on the right course.

Without appropriate forecasting, startups can be faced with poor decisions, spending sprees, or missing out on growth, which are all significant causes of new business failures.

Top Forecasting Mistakes That Make Startups Fail

Starting a business is exciting, but many startups close down because they make big mistakes while planning their finances. Forecasting is all about predicting sales, costs, and profits. If these predictions go wrong, the entire business can suffer. Below are the top forecasting blunders that cause startups to fail, and tips on how to avoid them.

1. Overly Optimistic Revenue Predictions

Many founders believe sales will grow super-fast right after launch. This “wishful thinking” often leads to hiring too many people or buying too much stock that no one buys. When money does not come in as expected, it becomes hard to pay bills and salaries.

Tip: Do not guess. Employ real market analysis, study your opponents, and keep client expectations realistic. Always make three versions of your forecast: best case, worst case, and most likely case.

2. Skipping Hidden and Variable Costs

It is simple to overlook such expenses as attorney fees, software packages, advertising, or even overtime for workers. Startups usually fail to account for unexpected price increases, seasonal costs, or one-time installation fees.

Tip: Enumerate all possible expenses, fixed and variable. Include an added cushion for unexpected expenses. Consult other founders and specialists so you know what costs you would likely overlook.

3. Not Revising Forecasts Ongoing

A forecast is not a one-time prep item. Markets, customers, and competitors shift rapidly. Relying on outdated forecasts keeps your business in the dark.

Tip: Check your forecast at least once a month. Update with the latest sales figures, new expenses, and industry trends as your new guide.

4. Relying Exclusively on Historical Data

Some founders just glance at what occurred last year. History is valuable, but it does not necessarily indicate the future. New customer behavior, technology, or unforeseen market shifts can render previous data useless.

Tip: Do not merely copy and paste statistics. Pay attention to your customers, observe industry news, and research emerging trends.

5. Ignoring Competitors and External Factors

Even a great forecast can fail if you do not consider outside factors like government rules, new technologies, or a competitor’s new pricing. Ignoring these changes can make you lose your market share.

Tip: Do a SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) whenever you update your forecast. Stay alert to competitor moves and industry news.

6. Confirmation Bias in Planning

Sometimes, founders only believe data that matches their hopes and ignore red flags. This “selective vision” creates false confidence and unrealistic plans.

Tip: Always question your beliefs. Ask for direct feedback from advisors or team members, even if it is uncomfortable. If something looks “too good to be true,” double-check it.

7. Making the Model Too Simple or Too Complex

A simple model can fail to capture risks, whereas a complex one will be unusable. Difficult-to-follow spreadsheets tend to conceal key signals and delay decision-making.

Tip: Focus only on the numbers that truly impact your business. Keep your forecast simple, clear, and easy to update for everyone on the team.

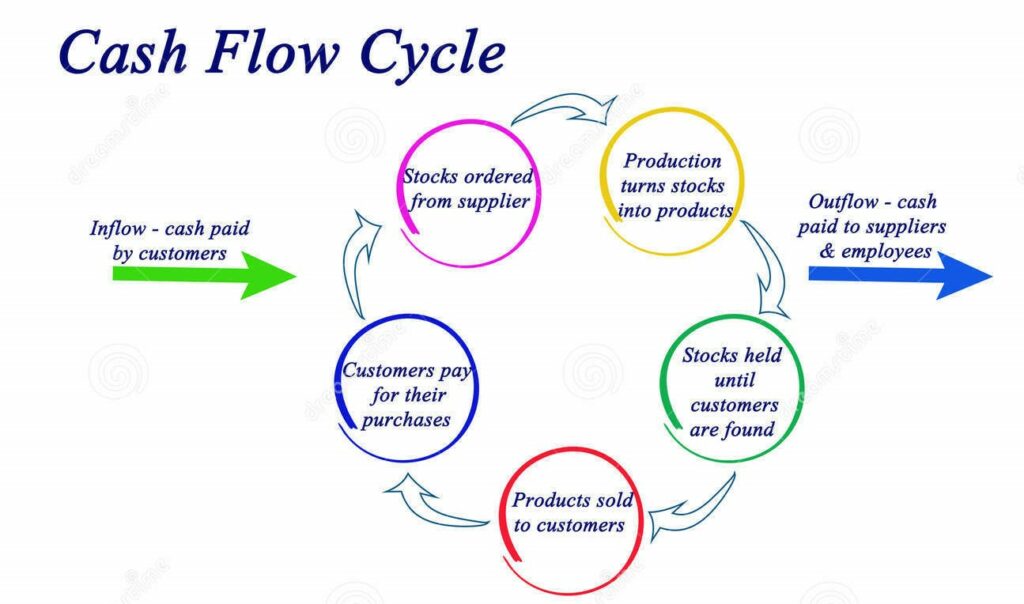

8. Ignoring Cash Flow Cycles

Some startups show profits on paper but forget that actual cash in the bank matters most. When customers delay payments, businesses can run out of money even if they look profitable.

Tip: Track cash inflows and outflows weekly. Always prepare for slow payments and big spending phases like product launches.

9. Underestimating Seasonality and Trends

The amount of money that all businesses receive in a year is not the same. An example of this is retail sales that may go up during the holidays but fall as soon as the season ends. You might find yourself in a situation where you do not have cash to meet your commitments because of low sales made without having planned ahead.

Tip: Examine seasonal trends within your market and set aside additional funds to counter low-sales months.

10. No Clear Revenue Model

Some startups never articulate well how they will generate money. Vague pricing, providing too many discounts, or lacking proper product-market fit can weaken and render unreliable forecasts.

Tip: Experiment with various sources of earnings, such as subscriptions, pay-per-use, or advertising. Construct your forecast on what the customers are willing to pay for.

11. Ignoring “Black Swan” Events

Rare and unexpected events like a pandemic, sudden economic crash, or new disruptive technology can completely shake up forecasts. These are called “Black Swan” events. You can not predict them fully, but ignoring the possibility makes your business more vulnerable.

Tip: Always prepare backup plans. Think about worst-case situations and create survival strategies in advance so your startup can adapt when surprises come.

12. Overspending on Tools

Many startups spend too much money on fancy software or tech tools just to look professional. The issue is that most of these tools do not solve real problems or help the business grow. This results in wasted money and a messy, overstuffed tech stack.

Tip: Pay only for tools that truly support growth. Use free or open-source options when possible, and review your tools often to remove the ones you do not need.

Conclusion

We are not referring to forecasting errors merely with respect to figures but with regard to all aspects of a startup, such as recruiting employees, attracting capital, and even producing a product.

With the ability to identify and prevent these typical mistakes, founders will have a better view of their own business, make more informed decisions, and increase their odds of success in the long term.

Bad forecasting should not drag down your startup. Rather, learn through them, be smart with data, and never be taken by surprise. In that manner, the process of building your startup will be a growth and opportunity-oriented process, not a fight to keep its head above the water.