From credit cards to student loans, mortgages, and car payments, so many individuals are used to owing money. But whereas debt is widespread, that does not make it normal—or worse, ‘cool.’

The truth is that debt can really get in the way of your financial health, mental sanity, and general happiness. If you are living paycheck to paycheck, money-stressed, or stuck in debt, it is time to do something about it.

Being in credit—being financially free and in control—can transform your life in ways you never thought possible. That is why going debt-free is the ultimate goal and how you can get there.

The Feel-Good Factor of Being Debt-Free

The best thing about being in credit is the amazing sense of relief and fulfillment it provides. If you do not have outstanding debt looming over you, you feel like a master of your financial destiny. Rather than dreading minimum payments, interest rates, and due dates, you can concentrate on maximizing your hard-won cash.

If you have ever felt the pressure of debt, you understand what it is like to be free from it. That weight of money can haunt you for years, but once it is behind you, you will feel an incredible sense of calm. Knowing that your money is yours—and not someone else’s—gives you a sense of security that nothing else can provide.

Freedom to Live the Life You Want

Debt has a sneaky way of dictating your life. It influences your job choices, your lifestyle, and even your ability to take vacations or make big life decisions. When you are constantly making payments towards debt, it can feel like you are working to stay afloat rather than truly enjoying your income.

Conversely, when you are debt-free, you are free to choose what you want to do based on your own desires and not on your financial commitments. Do you want to see the world? You can work for it. Do you want to change careers? You do not have to think about loan repayments. When your money is really yours, the world is your oyster.

Setting Yourself Up for a Secure Future

Debt does not just affect your present—it has long-term consequences as well. If you are consistently carrying debt, it can hinder your ability to save for the future. That means fewer retirement savings, missed investment opportunities, and even difficulties in buying a home.

By intentionally moving yourself out of debt and remaining on credit, you are preparing yourself for a secure and prosperous future. The faster you can eliminate the amount you owe, the faster you can begin amassing wealth, investing, and attaining financial independence.

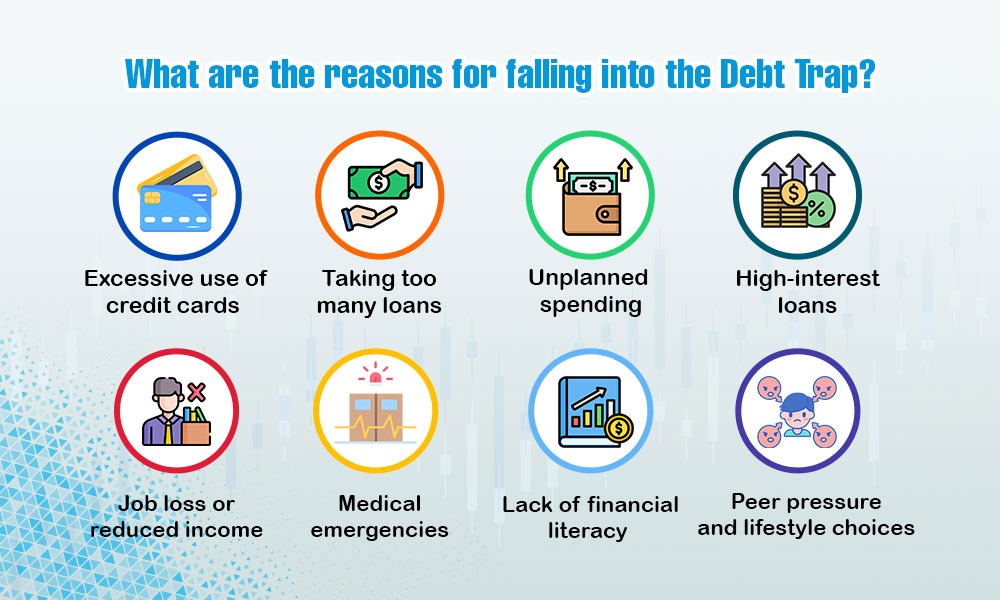

Escaping the Debt Trap: What Can Be Learned from Celebrity Financial Mishaps

If you want evidence of just how destructive debt can be, look no further than some of the world’s most well-known celebrities. Despite making millions, many have ended up financially devastated through poor financial management, overspending, and accumulating debt.

Celebrities such as Mike Tyson, Nicolas Cage, and MC Hammer were in the news for their financial woes, demonstrating that whether you earn high or low income, poor spending habits can ruin you. Their errors are excellent lessons: overspending and building debt can bring about catastrophic effects, regardless of your income.

How to Start Living in Credit Today

Now that you know why it is worth being debt-free, let us get started. Here is how you can begin your journey towards financial freedom:

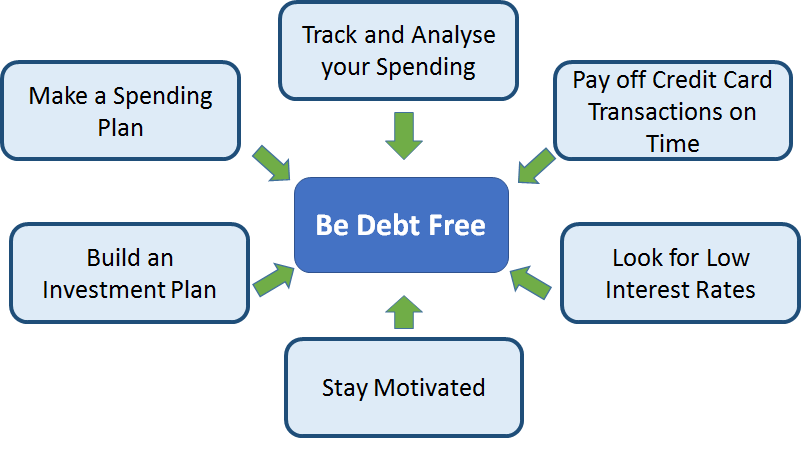

Know Your Debt

The beginning is to sit down and take a good look at your finances. How much debt do you have? What are your rates? Knowing your debt is key to making a plan to eliminate it.

Make a Budget & Stick to It

Budgeting is key to becoming debt-free. Monitor your income and spending, reduce wasteful expenses, and put additional funds towards debt repayment.

Pay High-Interest Debt First

If you have several debts, focus on paying the highest interest debts first. This method, the avalanche approach, will save you the most over time.

Do not Take on New Debt

As you pay off current debt, avoid taking out new loans or credit card accounts. Learn to live within your means and prioritize saving.

Establish a Fund for Emergencies

Another common reason individuals get into debt is unforeseen expenses. By saving for emergencies, you will be able to avoid using credit cards when unforeseen expenses occur.

The Mindset Shift: Prioritizing Financial Freedom Over Debt

Going debt-free is not merely a matter of numbers—it is a change in attitude. Altered thinking regarding money and expenditure will leave a lasting impression on your financial well-being. Rather than perceiving debt as the norm, begin to see financial independence as the ideal.

If you make it a point to always be in credit instead of being in debt, you will end up making better financial choices. You would not make Impulse purchases, and you would prioritize financial security over a long period instead of short-term pleasure.

Conclusion

In a world where debt is the norm, opting for financial freedom is a courageous and liberating step. When you liberate yourself from the bondage of debt, you get peace of mind, greater control over your life, and the power to build a secure future.

The path to debt freedom would not be simple, but it will be worth it. Begin today making moves to end debt, create wealth, and enjoy the amazing sensation of financial independence.