Habits add up when it comes to your finances. You might not even know it, but how you deal with money—whether you are a spender, a saver, or in between—is a habit. Most of these habits surrounding money are passed on from parents, learned through experience, or picked up due to necessity.

If you have ever been in debt, you know the willpower it requires to pay it off. You needed to budget, cut back on unnecessary expenses, and get your financial responsibilities in order. These behaviors were not only helpful in paying off your debt; they were the key to restoring your financial philosophy.

But then, what do you do after you have made your last payment? Most people take a deep breath and fall back into pre-debt-spending ways, but that is a mistake. The money skill that assisted you in paying off debt can now unlock wealth. Here is why it is best to continue those habits after paying off debt.

Supercharge Your Savings

One of the biggest benefits of maintaining your debt-paying habit is being able to supercharge your savings. If you were already spending $500, $1,000, or more monthly in debt, you have already demonstrated that you can live without it. Do not waste it; put it into a savings account instead. If you are saving for a rainy-day fund, a down payment on a home, or a dream getaway, keep it up, and you will always have a financial buffer.

Think about setting up an automatic transfer to your savings account for the same dollar amount you were using to make debt payments. It makes saving automatic and keeps you from being tempted to spend extra money just because it is available.

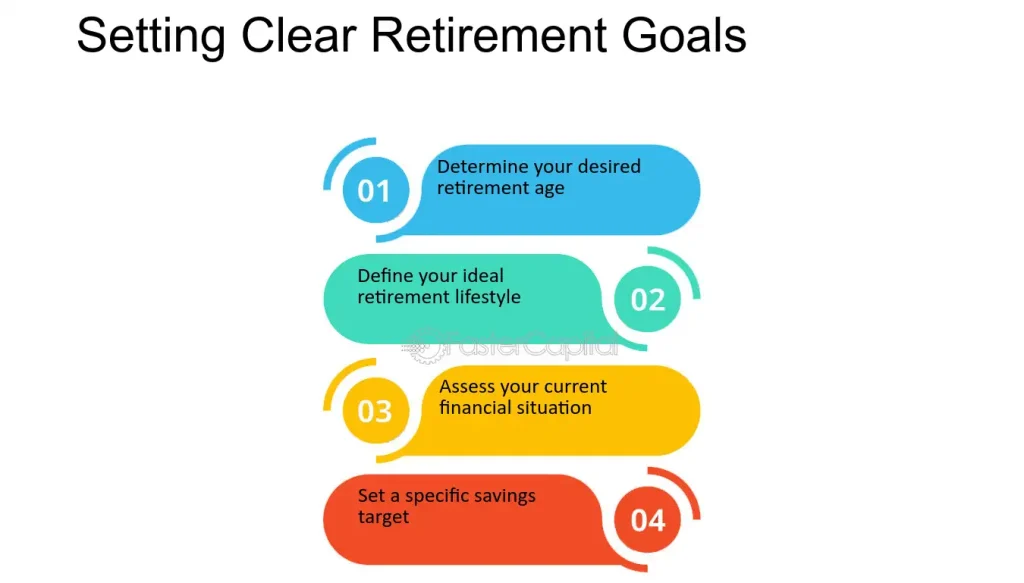

Build Your Retirement Nest Egg

Getting out of debt does not mean the end of your financial responsibility. If anything, you now have the ideal opportunity to begin planning ahead. You need to plan for retirement, and the funds that were being used to retire the debt can be deposited into the retirement account. You can invest in a 401(k), an IRA, or even consider options like a gold IRA rollover. Whatever your decision is, making smart decisions now will amount to a calm and secure future.

It is advisable to save 15% of your salary for retirement, and if you could not save this during the debt repayment years, now is the time. You can save more for retirement, and this will compound your investment in the long run and ensure financial independence in your later years.

Develop a Good Financial Attitude

Arguably, the greatest advantage of paying your way out of debt is the personal financial accountability that you build up in doing so. You will be able to budget, make sound spending choices, and distinguish between needs and wants. These are not merely skills that will help you become debt-free but equip you for a lifetime of fiscal prosperity.

By being mindful of how you spend and saving prudently, you will avoid getting sucked into unhealthy spending patterns that will bring in new money troubles. It is not that you cannot splurge sometimes, but you should ensure that those splurges fit within a responsibly crafted budget.

Maintain a Healthy Credit Score

Good habits with money save you money and also increase your credit score. When you are debt-free, your credit usage ratio decreases, which can significantly improve your credit score. But if you suddenly start to accumulate debt on credit cards again, that good work can quickly be undone.

By maintaining the same disciplined spending habits that you used to become debt-free, you can ensure your credit rating remains in excellent shape. An excellent credit rating will make it simple to be approved for low-interest loans, improved mortgage options, and even employment in a few fields.

Live True Financial Freedom

Perhaps the most fulfilling advantage of being debt-free is the feeling of financial independence. You are no longer weighed down by concerns over making payments, interest fees, or the weight of debt encumbrance. But financial independence is less about getting yourself out of debt—it is about sustaining habits that will keep you out of it for good.

As you keep practicing good money management, you start having the freedom to decide on what you really want, not on what you can afford to pay for at the moment. You can treat yourself to experiences, go on a vacation, venture into business, or give to your preferred causes—without fear of financial strangulation.

Conclusion

Eliminating debt is a great achievement, but it is merely the start of your financial success. By maintaining the practices that allow you to eliminate debt, you position yourself for long-term financial success. Rather than falling into bad spending habits, discipline yourself in saving, investing, and good money habits.