When you are choosing a mortgage, one of the largest decisions you will make is to decide on the best mortgage term. From the time-tested 30-year fixed-rate mortgage to shorter 15-year terms, adjustable-rate mortgages, or even customized loans, options abound. But how do you know which one is right for you? Understanding how each mortgage term will impact your finances is the first step in making an educated decision.

In this article, we will examine various mortgage term options and illustrate how they will affect your cash flow, saving over the long term, and overall financial plan. Whether you are starting down the path toward homeownership or maximizing your current mortgage plan, there is a term option available that can serve your needs.

The 30-Year Fixed-Rate Mortgage: A Commitment for Life

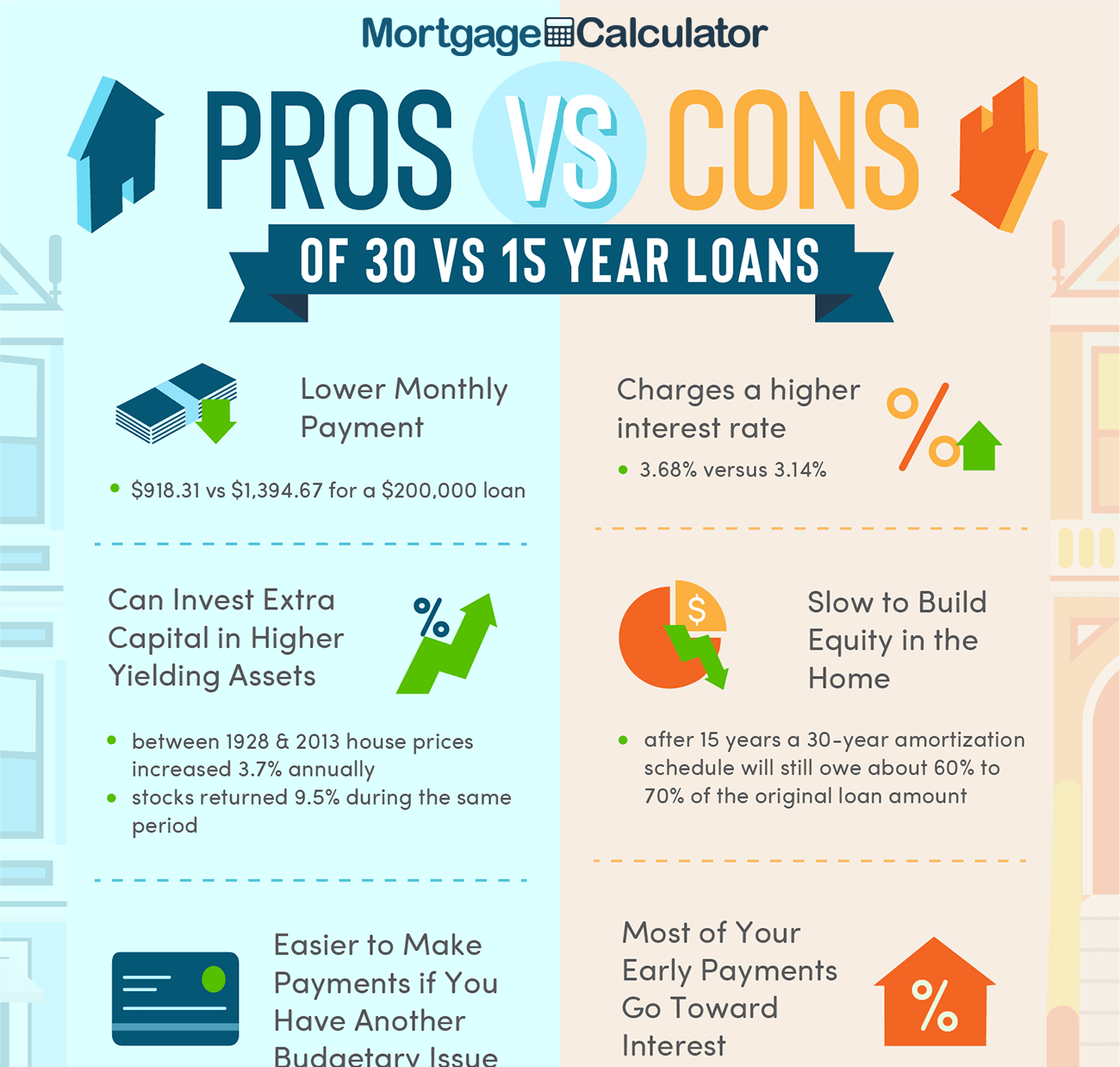

The most widely used option by far is the 30-year fixed mortgage, and it is not difficult to understand why. The long-term loan gives homeowners the benefit of making relatively smaller payments each month for a longer period of time, and that makes it an extremely appealing option to many.

Where the lower monthly payment is appealing, though, keep in mind the total cost. With the mortgage lasting 30 years, you will pay more interest over the life of the mortgage than with shorter mortgages.

But this longer time horizon gives you a little wiggle room in your budget, which can come in handy if you are budgeting for later-in-life milestones or saving for other purposes, such as retirement funds or paying off high-interest debt.

The 15-Year Fixed Rate Mortgage: The Path to Stepped-Up Equity

If you can handle the additional amount each month, the 15-year fixed-rate loan is a wise strategy to build equity in your home sooner. You will have more monthly payments in this scenario, but your loan will be completed in half the time of a 30-year loan. You will have less total interest over the life of your loan.

You also typically pay an even lower interest rate when you take out a 15-year fixed mortgage—even as much as a 1 percentage point lower interest rate than when you take out a 30-year mortgage. In dollars, it could amount to tens of thousands less in interest paid throughout the life of the loan.

For those who desire low-interest costs and build equity through their house, the 15-year home loan is your best option. If you would like to retire free from any debt or clear the house within a shorter span of years, this mortgage option will serve you best.

Adjustable-Rate Mortgages (ARMs): Flexibility with Risk

Another type of mortgage to look into is an adjustable-rate mortgage (ARM). With an ARM, the interest rate on your loan is set for a certain period of time, and then it floats to the prevailing market rate, usually once a year. For instance, the most popular ARM is a 5/1, where the interest rate is set for the first 5 years, and then it resets each year.

ARMs typically have lower initial interest rates than fixed-rate loans, so they are appealing to homebuyers who anticipate selling or refinancing prior to the rate adjustment.

But ARMs do carry inherent risks. After the fixed period ends, the interest rate can increase, and your payment can jump significantly. This unpredictability can be daunting for some homeowners, so you must think about whether you would be comfortable with potential fluctuations in your mortgage payment.

Comparing Mortgage Payments Across Terms and Rates

When deciding between mortgage terms, it is well worth comparing how the monthly repayments are going to work for each of the different loans. Here is an example of a monthly repayment on a $300,000 loan for some of the various mortgage types:

When evaluating mortgage options, it is essential to consider both the monthly payments and the total cost over the loan’s lifespan. Here is an updated comparison for a $300,000 loan:

15-Year Fixed-Rate Mortgage at 5.92%:

- Monthly Payment: Approximately $2,537

- Total Cost Over 15 Years: Around $458,660

30-Year Fixed-Rate Mortgage at 6.75%:

- Monthly Payment: Approximately $1,945

- Total Cost Over 30 Years: Around $700,200

5/6 Adjustable-Rate Mortgage (ARM) at 7.15%:

- Monthly Payment for Initial 5 Years: Approximately $1,948

- Total Cost Over 5 Years: Around $117,880

Although the 15-year fixed-rate mortgage has a higher monthly payment, you are able to pay off your home earlier and avoid a lot of interest. The 30-year mortgage offers a lower payment, which might be ideal if you need cash flow flexibility. The ARM comes with the lowest payment in the short term but keeps the risk of escalating prices after the initial fixed duration in mind.

As you might be able to see, the 15-year fixed-rate mortgage works out to so much more money in the end, even though it will cost you more in each monthly payment. This is because you are paying off the loan in a shorter time frame and, therefore, paying less interest in the long run.

Finding the Best Fit for You

Finally, the most suitable mortgage length will depend upon your financial scenario, your near-future aspirations, and what level of danger you are able to tolerate. If you crave long-term solidity and lower month-to-month installments, a 30-year fixed-rate loan is a winner. If you want to accelerate your house payment and retain more of your funds away from lenders, the 15-year mortgage might be the solution for you. If you anticipate moving or refinancing in the near future, an adjustable-rate mortgage can yield short-term benefits at relatively minimal risk.