Want to retire today? Or 25 years from now? Either way, one major financial cost (and concern) in retirement is healthcare. Unexpected health costs could bankrupt your life of leisure or derail your retirement plans.

With healthcare costs rising each year and the increased care you might need as you age, you can not depend on lady luck. Let us show you how to plan for healthcare costs in retirement, 100% tax-free, and save money on yearly health costs.

Why Healthcare Planning Matters

As you get older, healthcare is turning out to be much more significant. The costs for medical care rise daily, and some health issues that pop out of the blue may very well clear your savings if you are not adequately prepared to face the challenge. Although Medicare may give a sense of security to those over 65 years, it does not cover all the ailments. Also, living longer means these costs could compound because of inflation; therefore, an effective plan should be drawn out.

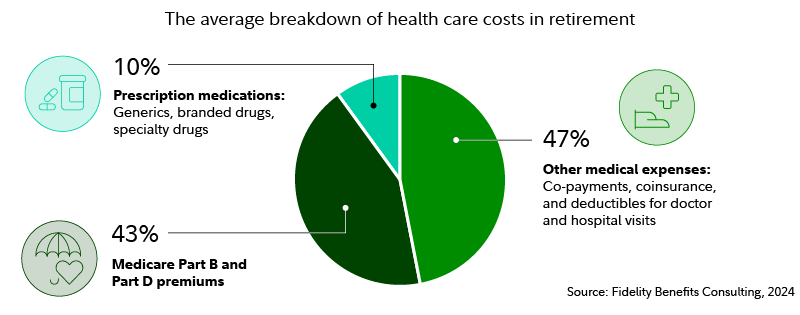

A study from Fidelity Investments estimates that a 65-year-old couple retiring today will need an average of $315,000 to cover healthcare expenses throughout retirement. This estimate includes premiums, copayments, and out-of-pocket expenses but does not take into consideration long-term care. Being aware of such realities can make planning more manageable.

Understanding Medicare

Medicare is a huge part of the healthcare landscape for retirees, though it does have some limitations. It is mainly divided into four parts:

- Medicare Part A: It covers inpatient hospital care, nursing facility care, and hospice care. Most participants do not need to pay a premium, though coverage is not for all.

- Medicare Part B: Outpatient Care, Physician Visits, and Preventive Services: The premium is paid for Part B, which often has deductibles and coinsurance.

- Medicare Part C (Medicare Advantage): A private insurance that pays for everything under Part A and Part B, adding the features of vision, dental, and prescription drugs.

- Medicare Part D: This covers prescriptions but brings in its separate premium and out-of-pocket expenses with it.

Understanding these components will further prepare you to project future medical expenses and establish whether additional coverage via a Medigap policy or a Medicare Advantage plan is needed.

Long-Term Care Considerations

One of the more major healthcare-related expenses with which retirees must concern themselves is long-term care. Services may include assisted living, nursing home care, and in-home healthcare. Usually, Medicare does not cover long-term care, leaving many retirees poorly prepared for high potential costs.

Consider long-term care insurance. It is expensive, but it could save you from depleting all your retirement funds if you need three to five or more years of care. Other options include establishing a separate dedicated fund to pay for long-term care or exploring hybrid insurance products that combine life insurance with long-term care coverage.

Developing a Healthcare Savings Plan

Image: Azasrs

A number of steps must be considered for health care cost planning in retirement. Here are the key steps:

Budget for Medical Expenses: Estimate how much you will need each year for medical expenses. Add up premiums, copayments, out-of-pocket costs, and ongoing expenses for services you use regularly, such as dental and vision care.

Health Savings Account: If you are still working and have a high-deductible health plan, consider opening an HSA. Contributions are tax-deductible, growth is tax-free, and withdrawals for qualified medical expenses are also tax-free. HSAs can be powerful tools for covering healthcare costs in retirement.

Control Prescription Drug Expenses: Prescription drugs can be very expensive. Study your Part D or Medicare Advantage plans carefully to determine whether they cover the prescriptions you take. Using generic drugs and other services that allow mailing prescription medications also helps reduce costs.

Consider Medigap Insurance: Medigap insurance pays for some of the expenses that Medicare doesn’t. These include copayments, coinsurance, and deductibles. These policies charge a premium but give peace of mind in case you use medical services regularly.

Stay Healthy: Prevention is one surefire way to keep medical expenses at bay. Regular check-ups, good nutrition and exercise, and proper maintenance of chronic conditions will go a long way toward reducing future health costs.

Planning for the Unexpected

No matter how well you plan, unexpected health problems can still occur. Establishing an emergency fund to cover at least six months of living expenses will help you weather these surprises without blowing your financial plan. If you are married, you and your spouse should have a conversation about your healthcare plans since the medical needs of one partner can greatly affect what happens with your combined finances.

Reviewing and Adjusting Your Plan

Healthcare planning is not a point-in-time activity. Review your plan once a year and make changes to reflect your current needs. A change in health status, available Medicare options, or financial position may dictate a change in your plan. Work with a financial advisor who understands the nuances of health care in retirement as well.

Health Costs in Retirement

Let us get down to brass tax. Healthcare costs in retirement are expected to exceed $275,000 per couple, on top of Medicare coverage. Preparing for these costs with dedicated health savings ensures you won’t need to pull funds from other traditional retirement accounts like a 401(k) or IRA.

Added Health Savings Flexibility

How can you prepare for these costs? Open an HSA. An HSA or Health Savings Account is a personal savings account for health expenses. HSAs are owned by individuals and can be transferred from job to job or institution to institution. Once you open an HSA, those funds are yours for life.

HSAs allow for tax-deductible contributions, tax-free interest, and tax-free withdrawals (if used for medical expenses). In 2019, individuals can contribute up to $3,500 in tax-free savings, and families can contribute $7,000.

You can decide to save, spend, or invest your HSA funds to balance your healthcare costs this year and prepare for health costs next year and in retirement.

To top that off, after the age of 65, you can use your HSA funds, just like a 401(k) or IRA, for anything. An HSA might be the new stealth IRA you have been looking for.

Decreased Healthcare Premiums

HSAs work with HSA-eligible health plans, like HDHPs, to help you save tax-free money for all of your expected and unexpected health costs.

Traditional healthcare plans like PPOs and HMOs have exceptionally high coverage but are saddled with high set monthly premiums. HDHPs (High Deductible Health Plans) have lower monthly premiums. You get the safety net you need, but do not pay for unnecessary coverage you don’t. Your HSA can help reduce the financial obligation that might arise until you reach your deductible.

Unlike traditional retirement savings like a 40(k) or IRA, you have the added flexibility to use your HSA funds today (for qualified medical expenses) or save for years to come. You get to choose the right balance for your lifestyle and not have it dictated by stringent IRS guidelines.

HSAs provide dedicated tax-free savings for health costs that you need in retirement. This means you can use your 401(k) and IRA for whatever you intended and not have those funds eaten away with trips to the doctor, hospital, or pharmacy.

Combine the savings power of a 401(k), IRA, and HSA to maximize your tax advantages for retirement. You save more of what you earn today and have more for tomorrow!

Conclusion

Healthcare costs in retirement are most definitely not something one can or will avoid, and the sooner one starts thinking about it, the better. Understand your options, draft a realistic budget, and learn about strategies such as HSAs and supplemental insurance. Take control now to protect your retirement resources and enjoy your golden years.