If you are a small business, you must manage your finances using an accountant to ensure that your business is running smoothly. Keeping your small business bills down is actually easier than you think, and you can use many of the same techniques that you would use when trying to reduce your household bills.

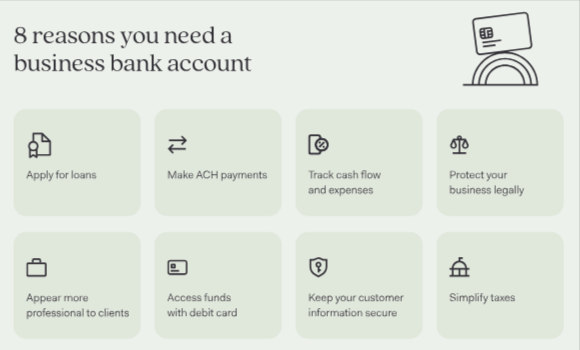

Once you have registered your small business, the first thing that you will need to do is find a business bank account, which can be expensive. Here, we are taking you through our top tips that you should follow as a new small business.

Choose the Right Bank

Not all banks are created equal, and a savvy business owner knows where to place their money. Take some time to compare banks around you. Some offer free checking accounts for business ventures, and other banks might provide some perks like low loan rates or money management tools online. Choose a bank that knows about small businesses and accommodates them.

Look for banks that have excellent customer service. You never know when you will have a problem or need quick help.

Try and Use a Personal Account

Are you a sole trader and not a limited company? Then, great news! You can use a personal banking account instead of a business bank account. Personal accounts are normally much cheaper to use than business accounts, and so, financially, it makes sense to go with an option such as one of these BB&T accounts, as this will keep your costs down.

Using a Business Account – Lowest Charges

If you cannot open a personal account, you may need to opt for a business bank account. Your bank can advise you on this, and they normally will do this if you have to deal with quite large sums of money, have a lot of transactions going through, or need to bank a lot of cash.

When you are looking for a bank account, you will want to try to choose one that offers as many perks as possible. You may be looking for a bank account that offers unlimited free daily transactions and a bank that offers in-credit interest.

These types of banks are similar to consumer bank accounts, but they tend to have limited features. You also have the option to get extra features with your business banking account, such as accounting software and business assistance, but this will cost you money.

Separate Business and Personal Finances

Mixing the personal with the business account is one of the worst mistakes a small business owner could make; this can become extremely complicated during tax season, potentially making your business seem somewhat amateur. Maintain clear record books by opening up another separate business account in your bank.

This helps monitor expenses, set budgets, and make applications for loans. This even helps in protecting personal assets if the business incurs some legal issues.

Try and Minimise Your Charges

No matter what kind of bank account you have for your new small business, a priority should always be to try to minimize the charges that you pay. When running your business, you should try and operate in a way that minimizes these charges. For example, try to always stick to online banking and cut down on how much cash you are paying into the account. You should also be trying to use automated transactions if you can, and do not use unauthorized overdrafts.

Automate Payment and Transfer

Running a business means there are a million things on your mind. Paying bills or transferring money should not be another thing to worry about. Automate regular expenses such as rent, utilities, or loan installments. You can also automate transfers to your savings account to build a safety net.

You save on late fees because it automatically pays on time. A good credit score is of utmost importance if you ever want to take out a business loan.

Put Cash into Savings

Once you have your new business up and running, you will be in a position where you have built up cash in your account. So, it is important that you have a business savings account linked to this. This allows you to put all your money in one place and maximize your interest.

Building a Relationship with Your Banker

A good relationship with your banker opens avenues for your business. They can give you advice, tell you about new services that might help, or make the loan application process easier. Even if your bank has great online tools, make an effort to meet your banker face-to-face now and then.

When your banker understands you and your business, it is in a better position to assist you when problems arise.

Loan Options

Sometimes, your business needs extra cash to grow, and that’s fine. Banks offer different kinds of loans for small businesses. It’s important to know the options and pick what’s best for you. Short-term loans are good for quick needs, while long-term loans can help with big investments like new equipment or expanding your space.

This ensures that before getting your loan, you will first prepare a solid business plan with a good credit record history. This makes chances favorable for loan approval to get your business.

Keep an Eye on Fees

Fees can be one of the largest profits for banks, but you should not have to pay more than is necessary. Look through your statements and find hidden charges that may apply, like overdraft fees or minimum balance fees. If you feel your bank is charging you too much, you should not be afraid to try negotiating with them or moving your accounts elsewhere.

Did You Know? Some banks will waive fees if you sign up for certain services or keep a minimum balance, so always ask about ways to lower your costs.

Use Online and Mobile Banking

Most banks provide online and mobile banking, which makes the management of your money very easy. You can make transfers, pay bills, and check your account balance anytime and anywhere. This is also a good way to keep track of your finances and avoid surprises.

Make sure your bank’s app or website is secure. Use strong passwords and enable two-factor authentication to keep your account safe.

Plan for Slow Periods

Every business faces ups and downs. When the income is not regular, prepare for the slow months. Saving more during the busy months or setting up a line of credit can help you ride through the bad times. With preparation, the stress on your business will be less, and it will float up again.

Conclusion

Running a small business is definitely not an easy task. However, smart banking is sure to ease things. The right bank, orderly management of finances, and planning for the future can be the ideal ways to set up the growth and success of an enterprise in a strong position.