Rule number one: Do not go house-poor when buying a new home. Experts say your house payment should be approximately 25% of your take-home pay, while others say you can go as high as 30% if you have no other outstanding debt and do not plan on going into debt. Many people find using a house payment calculator to estimate the payment on a new mortgage very helpful in finding out how much you can afford.

In this blog, we will examine how to assess your mortgage affordability, the important variables that affect mortgage payments, and responsible debt management advice.

Understanding Mortgage Payments

A mortgage payment is a regular installment made to a lender in return for allowing one to take out a loan to purchase a home. It will contain several components, which typically include the following:

- Principal: The amount you borrow.

- Interest: The cost of borrowing money, expressed as an annual percentage rate (APR).

- Taxes: Property taxes may be escrowed or included in the mortgage payment and paid to the local government.

- Insurance: Homeowners insurance and, where applicable, PMI if your deposit amount is less than 20%.

The size of your monthly mortgage payment will depend on the loan amount, the interest rate, the term of the loan, and property taxes, among other factors.

Home Budgeting

Homeownership comes with a monthly mortgage payment. Often, home buyers are tempted to buy a home priced higher than they can comfortably afford. First-time homebuyers are especially susceptible to this, perhaps forgetting to include the costs of taxes, insurance, and repairs when creating their budgets.

You can do this by researching available properties online. Start by thinking about the must-haves in your homes, such as the number of bedrooms and bathrooms or a sizable yard. Then, look up comparable properties that are currently on the market in your area to get a sense of what you can expect to spend.

Can you not afford to paint your house? That is a sign that you can not afford the house in which you live. If you have to go into debt to perform the most basic of home maintenance, then you cannot afford your home. The worst part is that neglecting upkeep will only make your house problem worse. Your property value will suffer from your lack of attention. This increases housing liquidity concerns.

You have been making mortgage payments for years, but every time you look at your account statement, it seems like the principal balance barely budges. What gives? It is normal to pay mostly interest when you first get a loan, but over time, your money should increasingly go toward paying off the principal. If you find that you are not paying down the loan as quickly as you want, it could be because your interest rate is too high or your term is too long (or both.)

Factors to Consider Mortgage Payments

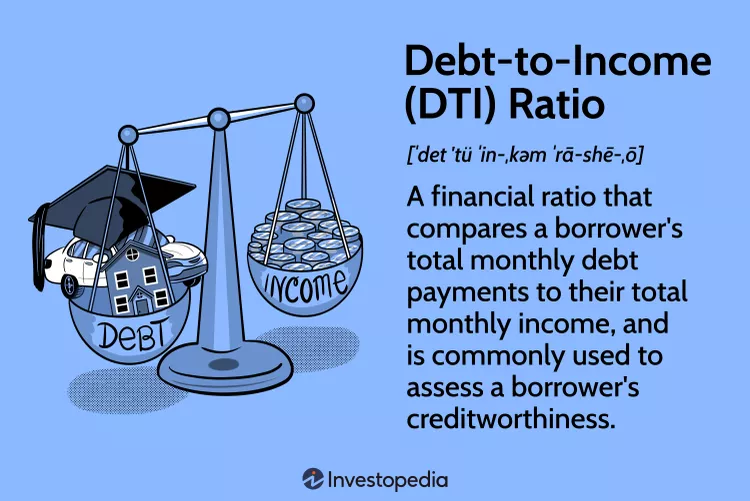

Debt-to-Income Ratio

Your debt-to-income ratio, or DTI, is another key factor that most lenders use to determine how much mortgage you can afford. DTI is a calculation of all your monthly debt payments divided by your gross monthly income, expressed as a percentage.

Example: Your debt payments every month alone reach $2,500, and your income per month reaches $5,000. In this case, your DTI will be 50%. Lenders generally prefer a DTI ratio of 43% or less, although some may accept higher DTIs for borrowers with good credit history or other compensating factors.

While the 28/36 rule focuses on your total debt load, your DTI is an even more accurate way to determine how much you can really afford in terms of a monthly mortgage payment. The lower your DTI, the more money you can borrow without assuming undue financial stress.

Refinance your Home with a Longer-term Mortgage

Household income can decrease for various reasons, like losing a job, choosing to become a stay-at-home parent, or getting a divorce. Any of these situations can make it much harder to make that monthly mortgage payment. Try refinancing your home with a longer-term mortgage to reduce monthly household costs. If that is not feasible, it may be time to look into buying a more affordable property.

Other Factors to Consider

Just how much a mortgage is considered too much can depend on various other factors that will impact your long-term financial well-being.

Down Payment

The amount of money you put down as a down payment impacts your monthly mortgage payment. By putting down a larger amount, you’ll have a smaller loan, which means your monthly payment will be much easier to handle. It can also save you from paying PMI, which you will be required to pay if your down payment is less than 20%.

A down payment of 20% or more makes sense for some borrowers, though it is not always necessary. Many first-time homebuyers can buy a home with less than this threshold because of government-backed loans such as FHA or VA loans, though sometimes with added costs.

Interest Rates

Your interest rate can greatly determine your mortgage payment amount. With a low interest rate, your monthly payments are lower, and the overall interest you pay on the life of the loan is less. Correspondingly, with a high interest rate, your mortgage payments will be higher, and you will eventually pay more in interest.

Your interest rate will depend on a number of factors, including general economic conditions and your overall creditworthiness. Saving a few tenths of a percent on an interest rate can save you thousands of dollars over the life of your mortgage. Simply having the foresight to compare rates from a number of different lending institutions can save you significant money.

Length of Term

The term of your mortgage refers to the length of time you will take to repay the loan. Though 30 years is the general trend, 15-year and 20-year mortgages are also available. A shorter term generally means higher monthly payments but less interest paid over the life of the loan, while a longer term can mean lower payments but more interest paid in the long run.

The choice of term depends upon one’s financial goals and affordability. A 30-year mortgage is more affordable in the short run but costs you more in interest over time.

Future Financial Plans

When selecting the mortgage amount that you can afford, you must consider long-term financial goals. Are there other major purchases that you will be trying to make shortly? Are you planning on having children or taking on other added financial responsibilities? Are you assured of two incomes on which you can rely, or are you planning for a possible job change?

These will give you an idea of whether taking on a larger mortgage is doable or whether you need to scale back.

Conclusion

Taking on too large of a mortgage for your budget can be a real source of financial stress. Paying too much of your income toward your mortgage might make it tough to pay for other important expenses such as groceries, utilities, and healthcare. This may often lead to missed payments, added penalties, and foreclosure in extreme cases.

Also, stretching to qualify for a large mortgage reduces your potential to save for retirement, emergencies, or other important financial goals. You could also suffer mental and emotional stress since the burden of debt will eventually become increasingly difficult to handle.