Small and medium businesses always need funding. Right from the initial idea of kickstarting the business to all the management purposes, there is a need for capital. Large enterprises can easily gather finances, but the case is not the same for small and medium businesses. Given their contribution to economic development, financial institutions must fund them. They encourage both self-employment and overall employment opportunities for the country.

The funding companies

All over the country, there are a number of companies that provide financial aid to small and medium enterprises to get them going. One of the companies is the business backer. Located in The United States, the company provides a lot of financial options to companies like –

- SBA Loans (small business administration)

- The business line of credit

- Long-term and short-term loans

- Equipment Financing

- Merchant cash advances

- Commercial real estate financing

- Invoice factoring

- Start-up loans to fit a variety of business needs

The loans are tailor-made to suit the requirements of SMEs, provided all the necessary documentation is ready.

How to choose the lender

There are a variety of loans offered to businesses by lenders, but before getting into that, it is essential to realize the main agenda behind taking up the funding. There are a few questions that need to be answered –

- How much money is required?

- What is the reason for the fund requirement?

- Time needed to pay back the loan

- How old is the business?

- Current financial status of the business

- Collateral used for the fund

- The current credit score of the business

- Other outstanding loans, if any

- The loan requirement is short-term or long-term

After all these questions are answered, a variety of loans will appear. The goal is to choose the one that best suits the enterprise’s demands.

Kind of lenders

Various lenders are available, each with its pros and cons. One needs to scrutinize all of them to determine which is best.

- Small Business Administration loans—The Small Business Administration offers various loan programs for different kinds of businesses. The government does not lend the loan directly; rather, the guidelines are set by the partners (banks, community development organizations, and microlending institutions).

- Conventional bank loans—Loans from conventional banks are an easier option because of the lower interest rate and faster approval process. Still, the repayment period is short and may include balloon payments at times.

- Alternative lenders attract most SMEs because they offer online applications, and the loan is approved in a few hours. They also provide a variety of loan options from different lenders.

Reasons Why Businesses Need Funding

Businesses require funds for different purposes. Whether the initial setup cost or day-to-day management, expenses must be borne at every point in the business cycle. Let us discuss the most frequent situations where the need for funds is at its peak:

Infrastructure and Startup Costs: Most businesses require a huge sum of money for startup costs. Entrepreneurs need capital to invest in equipment, technology, space, and raw materials. These are quite initial costs. A lack of proper funding is a burden and may mean that a great business idea will never see the light of the day. Loans and funding from investors can make it possible for a new venture to be launched.

Working Capital: A business needs easy-flowing cash to function properly. Most enterprises can be hurt by cash flow problems emanating from clients’ late payments or seasonal downturns. Working capital loans ensure that salaries, rent, and utility bills are paid when revenues are not forthcoming and that businesses keep running without hitches.

Scaling: When any company is on its way to scaling, funding is even more critical. This could mean new location expansion, hiring more employees, or offering the product array. All this requires enormous investment. Loans and financing help businesses achieve growth without depleting reserves.

Inventory and Supply Chain Management: It often forces many retailers and manufacturers to hold inventories in advance of peak seasons or major promotions. Buying bulk inventory is costly and sometimes insurmountable for a small enterprise. This loan or line of credit may be used for such expenses while enabling the business to meet demand without stress.

Covering Unforeseen Expenses: The unexpected can strike when anything from a piece of equipment to an act of God goes wrong. Having money available can be a lifesaver. Business loans or savings coming from a financing plan yield the needed capital to make repairs, replace machinery, or stabilize a business during sudden interruptions.

Types of Business Loans

Understanding the options will, therefore, be indispensable in making appropriate decisions. Here are some of the common loan types businesses can consider:

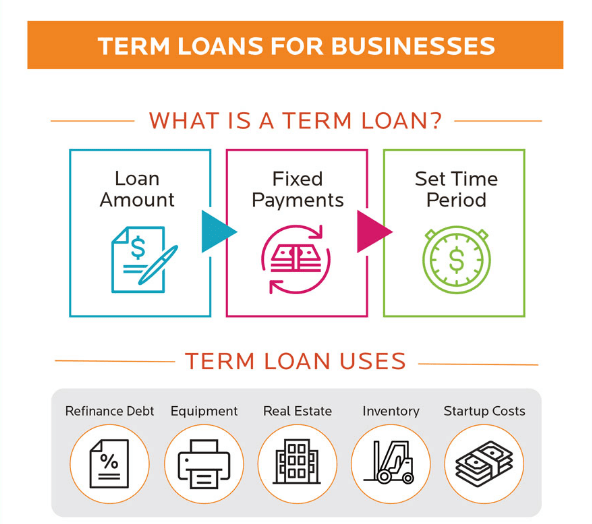

Term Loans: These are traditional loans whereby a business borrows a lump sum and repays it over a fixed period. They are suitable for major investments like purchasing property or equipment.

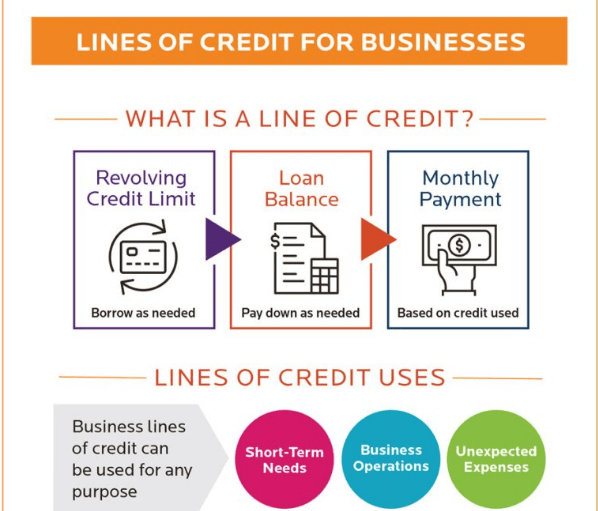

Line of Credit: Businesses can draw as much cash as needed in credit anytime up to a certain amount. It is an extremely flexible option to handle cash flow or shorter-term expenses.

Equipment Loans: Equipment loans are strictly for purchasing machinery or technology, whereby the purchased equipment becomes the collateral. This is the ideal option for businesses that wish to upgrade themselves without using their capital.

Invoice Financing: Invoice financing offers cash flow problems arising from unpaid invoices and an advanced amount of pending payments against such outstanding invoices. It is a quicker way to access cash without having to wait for the clients to pay up.

Merchant Cash Advances: It is ideal for businesses that require urgent cash. Repayment is made by deducting a fraction of its future credit card sales; hence, it is flexible but often more expensive.

Key Factors to Consider Before Taking a Loan

Loans can save a situation, but with loans come responsibilities. Here are some factors to consider:

Interest Rates and Terms: Compare lenders for the most favorable interest rates. Even with small differences in interest rates, there lies a huge difference in the total amount one has to repay. Understanding the terms and conditions will protect you from surprises.

Repayment Plan: Be sure your business’s cash flow can afford the repayment schedule. Missing any payments will lower your credit score and could be problematic when seeking credit in the future.

Collateral Requirements: Some loans are collateral-based, meaning you will have to give something up in return for this facility, such as property or equipment. This comes with associated risks, such as putting your assets on the line and whether your business will recover if the collateral is lost.

Purpose and Impact: Clearly define how this investment will be utilized and what revenue or return on investment may be expected. Funding must be a strategy for growth rather than a Band-Aid for poor financial performance.

Alternative to Traditional Loans

If loans sound scary to you, let us look at some other financing options :

Crowdfunding: This can be done through sites such as Kickstarter or Indiegogo, where companies raise finances from a large number of backers. This is usually in return for some form of reward or early access to whatever product you are producing. Angel Investors and Venture Capitalists: These are investors who will give you capital in return for equity. This means that you may have to give up part ownership of your business, but the expertise and networking opportunities that this can open up might prove invaluable.

Government Programs/Grants: Many locations, based on your location and profession, offer grants that do not need to be repaid. Check out local programs to see if you fit the criteria.

Conclusion

Finance and loans are the bedrock of business growth, stability, and innovation. While the very thought of debt might daunt many individuals, strategic financing can launch a business to heights that it would not have reached otherwise. The key lies in making informed decisions, weighing the benefits against risks, and having a clear plan on how funds will be used to drive your business ahead. With the right approach, securing funding becomes a powerful tool for long-term success.