For those who do not work in the financial industry, loans can be a rather confusing topic. All kinds of financial terms get thrown out there, and unless you are familiar with them, it can all be a bit confusing. Not learning what each of the terms means can, unfortunately, lead to thousands of dollars worth of fees, charges, and interest that only increase the cost of borrowing. In fact, if you do not understand the full cost of borrowing, it can become so expensive that the loan itself ends up being a poor financial decision.

One set of terms that is often lumped together, interchanged, and generally confused is APR and interest rates. All too often, people assume they are the same, which is not true at all. Here, we will examine APR vs. interest rate, dispelling any confusion.

APR vs Interest – Are They Different?

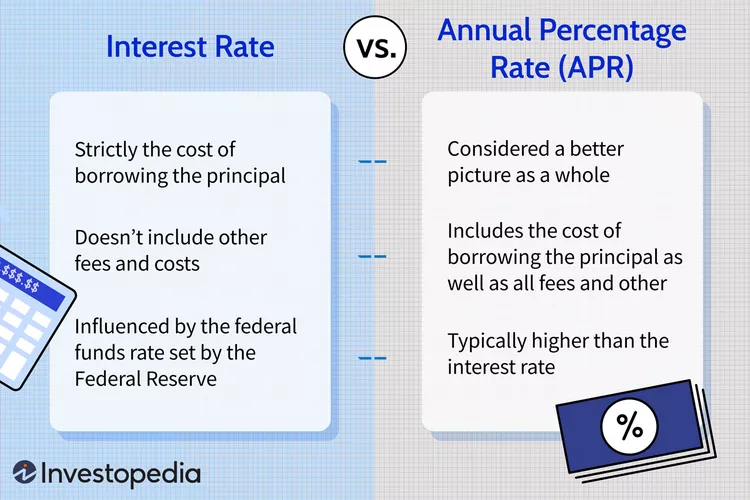

When investigating APR vs. interest, the first thing that may come as a surprise is to learn they are two totally different things. Both are reflected as a percentage, so it is easy to see one and assume they are the same and interchangeable.

Both APR and interest rates are meant to clarify the true cost of borrowing money. Let us say, for example, that the loan is for $10,000; well, that is not the true cost, as you need to factor in the APR and interest.

So, what is the big deal? Well, the differences between the APR and interest rate can be so large that the true cost of borrowing increases by thousands of dollars. That is a rather substantial amount of money.

APR 101 – Breaking Down the Basics

APR stands for annual percentage rate. It is a blend of any fees associated with loans and the interest rate itself. Some of these fees can be origination fees, discount points, and broker fees. You would be surprised at how quickly all these additional fees can add up and really impact the total cost of borrowing.

In essence, APR includes the interest rate along with things like:

- Origination fees

- Processing fees

- Discount points (in the case of a mortgage)

- Mortgage insurance premiums

- Other administrative costs

This makes APR a broader measure of what you will actually pay compared to just the interest rate alone.

In a nutshell, the APR is the additional fees and the annual cost of your loan reflected in a combined percentage.

Interest Rate 101 – Breaking Down the Basics

The interest rate tends to be the figure more people are familiar with and usually pay closer attention to. Like the APR, it is also reflected as a percentage. This percentage reflects the amount of money that will need to be paid back on top of the amount borrowed. Clearly, the lower the interest rate, the better since that means the true cost of borrowing is lower.

Types of Interest Rates

There are two major kinds of interest rates that you will run into:

Fixed Interest Rate: This is a fixed interest rate over the term of the loan. Now, predictability is an advantage: your monthly payments would not shift over time.

Variable Interest Rate: This may change over the life of a loan and is often tied to either a market index or even an index.

While the variable interest rate is often lower than the fixed rate at first glance, that rate can rise, in which case you will be paying more for the loan in terms of the cost of your loan over time.

Why does Interest Rate and APR Differ?

The bottom line here is the inclusion of costs. Interest rate, by definition, is an expense of borrowing money, whereas APR is the total of all interest charges tacked on to other fees you are going to pay at the loan term. Here is a more elaborate difference between the two numbers:

- Interest Rate: Primarily shows the lender’s charge for borrowing money, excluding all additional fees.

- APR: Compounds all the interest rates with other loan costs to give you a full picture of what you will have to pay over time.

Let us illustrate this by using an example, such as comparing two loans..

Loan A: 4.5 percent interest with no fees

Loan B: 4.3 percent interest, but also has fees of 1 percent of the loan

Even though Loan B had a lower interest rate, the APR would be higher because of the fees and might end up being more expensive in the long run.

How APR Works for Different Types of Loans

While the underlying principle of APR is the same across the loans, it behaves differently with respect to different types of borrowings:

Mortgages

With respect to mortgages, APR not only includes the interest rate but also the upfront charges in the form of closing fees, PMI, and points, and, hence, the comparison of mortgage loans is easier from their lender since they often present different combinations of rates and fees.

For example, one offers 4% in interest but charges a bit more in front-end fees, while another offers 4.25% but relatively low fees. The APR would give you an option to better compare which loan you pay more for in the long run.

Auto Loans

The APR is critical for auto loans because dealerships all too often use low interest rates to sell but may charge higher fees. Dealerships often give fabulous promotional interest rates that, while great-sounding, are only applicable to certain loan terms or to certain borrowers with stellar credit. The APR will reveal whether there are hidden costs attached to that attractive rate.

Credit Cards

For credit cards, APR is an extremely important deciding factor. As compound interest has become an integral part of credit card charging, there is every likelihood of APR becoming the actual carrying cost of carrying a balance. However, you must know that credit card APRs can be variable at times and that can shift in accordance with the market and/or your creditworthiness over a period.

APR or Interest Rate: Which Should You Focus On?

When comparing loans, know when to focus on the APR vs. the interest rate.

Focus on APR When:

You want to see a fuller price picture. APR includes fees and other costs, so you get a clearer picture of what a loan will cost you in the long term.

You are comparing multiple loan offers: With APRs, you can compare loans with different interest rates and fees that are comparable to “apples to apples.”

You are considering long-term loans like mortgages. The extra fees that appear in APR can really add up over the long haul, especially when you consider the closing costs and points of a mortgage.

Watch out for Interest Rate In:

You are comparing short-term loans. For short-term loans, the fees included in the APR may have less of an impact than the interest rate itself.

You understand your fees: If you know the fees and can factor those in the added cost of the loan, the interest rate might give you the direction you need.

You are refinancing or have low upfront costs: If you are refinancing, then you might well roll the costs of refinancing into the loan itself. In such a scenario, it makes more sense to go for that loan, where the interest rate will play a larger role in your decision-making.

Stay Informed and Make the Right Decision

By brushing up on your knowledge of APR vs. interest rates, you will be able to make an informed decision about getting a loan, as the total cost of borrowing will be clear. APR provides a more complete and accurate picture of the cost of borrowing, even if interest rates can first appear like the more appealing figure to pay attention to. You may pick the loan that best suits your financial circumstances and prevent unpleasant surprises by closely comparing the two.