For most Americans, 401(k) plans were once simply viewed as a retirement savings fund, something you saved now and left alone until you are older. But that is no longer the case. More and more people are tapping their 401(k) accounts to use as an emergency fund for unexpected expenses such as medical expenses, repair bills on their home, or even to prevent foreclosure. Let us discuss why this is occurring, what it signifies, and how individuals are handling their finances differently now.

What Is a 401(k) and How Was It Used Before?

A 401(k) is an employer-provided type of savings plan that allows employees to save for retirement. Typically, contributions accumulate and are not withdrawable without penalty before age 60. The idea is to accumulate a nest egg until you retire.

Making Use of 401(k)s as Emergency Funds

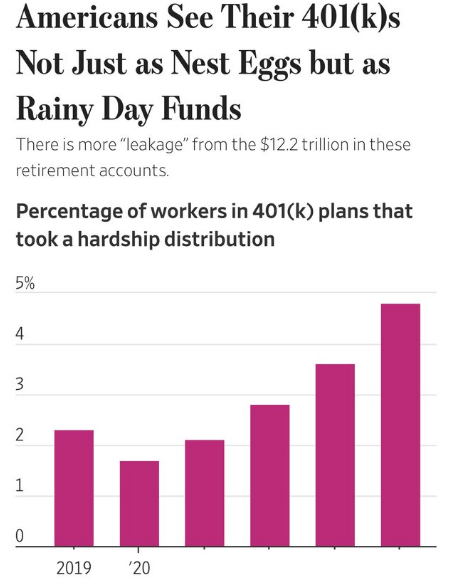

But in recent times, more and more Americans have been drawing on their 401(k)s somewhat differently. Rather than saving solely for retirement, they are tapping into their savings to pay for surprising expenses. The share of workers who made hardship withdrawals from their 401(k)s doubled throughout the pandemic and remains high today at around 4.8% last year.

In addition, most people who resign are cashing out their 401(k)s in full, even at the cost of additional taxes and penalties. This indicates that most are using their retirement savings as an emergency piggy bank.

Why Are Americans Using Their 401(k)s as Rainy Day Funds?

There are a few reasons why people are reaching into their 401(k)s before retirement:

- Falling Emergency Savings: Many Americans do not have enough cash saved just to cover three months of living expenses. A recent survey found that only about 46% have this “rainy day” fund, which is down from past years. When people lack liquid emergency savings, their 401(k) becomes their safety net.

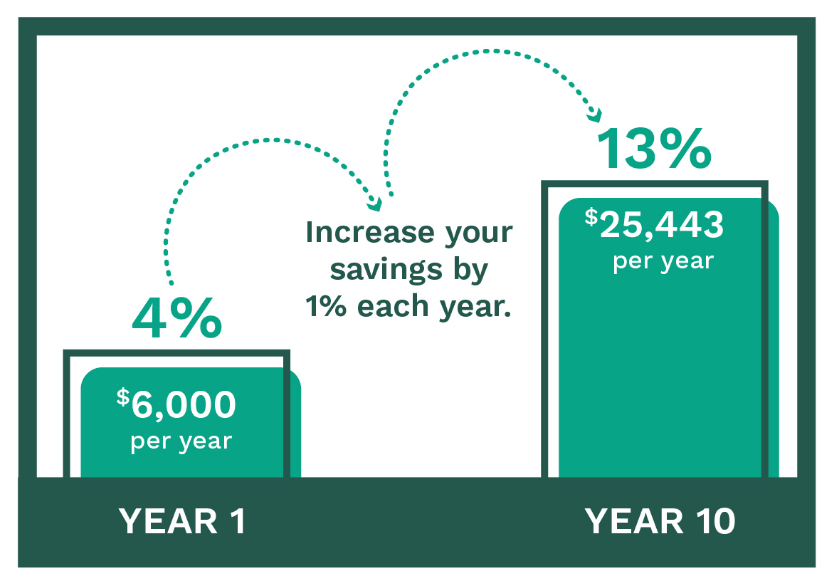

- Easier Access Rules: Laws have changed to make it simpler to withdraw money early from 401(k) accounts during financial hardship. Employers are also offering new options where workers can save specifically for emergencies inside or alongside their 401(k). For example, some companies let workers build separate emergency funds via payroll deductions, which can be withdrawn tax-free and penalty-free.

- Broader 401(k) Participation: More workers, especially hourly and lower-income employees vulnerable to income swings, are now automatically enrolled in 401(k) plans. While this is good for retirement savings in theory, these workers often need to tap their savings early when money gets tight.

What Are Companies Doing to Help?

Employers are starting to offer new options designed to help workers save specifically for emergencies, separate from retirement. For example, some companies let workers put part of their paycheck into a special emergency savings account through payroll deductions. These accounts can be withdrawn tax and penalty-free and help prevent employees from raiding their main 401(k) balances.

The new law allows for automatic enrollment in such emergency savings accounts for employees who earn less than $160,000. This can help people build a “rainy day fund” inside or alongside their retirement plan without risking their long-term savings.

How Employers Are Helping

Some big companies like Starbucks and Delta Air Lines now let workers put part of their paychecks into special emergency savings accounts. These accounts let people save a few thousand dollars that they can access quickly and without tax penalties. This helps stop them from pulling money directly from their 401(k) investments and losing retirement security.

What Experts Say

Experts note that tapping into your 401(k) can work as a rainy day fund and reduce how much money people have set aside for retirement. Each time you draw money out early, it means your savings do not have as much time to grow. This can be a big issue when you are in retirement and need those funds the most. Meanwhile, while having money available for emergencies is a good thing, it prevents people from further saddling themselves with debt during difficult times.

How Can You Save Your 401(k) and Accumulate Savings?

- Begin an Emergency Fund: Strive to save three months’ worth of living costs in a standard savings account or the new kind of workplace emergency fund, should your employer provide one.

- Avoid Premature Withdrawals: Use 401(k) funds prematurely only when you do not have any other option. The penalty and lost growth can end up costing a lot later on.

- Automatic Savings Features: If your company provides an emergency savings plan, sign up. These plans tend to save cash automatically from your check, which makes saving simpler.

- Budget and Plan: Create a budget where you set aside a little money every time for emergencies so you would not be forced to dip into your retirement money.

Conclusion

Americans are reevaluating their 401(k)s: not just as a nest egg toward the future, but also as an emergency fund today. This shift reflects how the economy and finance issues are impacting how individuals are spending and what they are saving. Emergency funding is significant, but early access to retirement funds can destroy long-term plans.

Business and political leaders are exploring more effective ways to enable American workers to meet both needs, benefiting finances in the present and in the future.

With an understanding of how 401(k)s are utilized today, you can make improved decisions for your financial future, building for tomorrow, while prepared for an unforeseen rainy day.