Others are simply not suited for traditional employment. Although they may be stuck in an office, factory, or warehouse for decades, their aspirations are far beyond the typical nine-to-five. They hunger for independence, the ability to be their own boss, and the authority to pursue their own ideas without someone telling them what they can and cannot do.

If you are an independent or are considering making the jump, chances are good you have experienced these emotions. There are plenty of advantages to being your own boss, but there are some surefire disadvantages—one of the biggest is economic security. Without the firm to rely on for steady paychecks, vacation time, and benefits provided by the firm, your personal financial situation is yours alone. It can be thrilling and terrifying.

But do not worry! Applying the correct strategies, you may be able to set yourself up for future financial wellness and security. Following are three important financial tips that can help you navigate through the sea of self-employment with ease

Always Have a Financial Safety Net

One of the most significant aspects of transitioning from working a standard job to being self-employed is sacrificing financial safety nets. With a standard job, there is a secure paycheck, sick pay, and holiday time, translating to fiscal security. When you are self-employed, these safety nets are eliminated unless you deliberately set them up yourself.

This is the reason why you should highly consider having a contingency fund. You should save six months of living expenses before resigning from your last job. In this manner, when it is slow, clients pay bills late, or some unforeseen circumstances arise, you would be in a bad situation financially.

Once you’ve built this cushion, you should leave it alone forever. Consider your savings account an emergency paycheck that will carry you over in times of need. You may even want to create a separate high-yield savings account where you can put these emergency funds so they’ll be left untouched except in times of true need.

Also, it is a good idea to invest in health and income protection insurance. It might seem like an unnecessary expense, but an illness or injury safety net can be a lifesaver. Without employer benefits, you are the only one who will be responsible for paying for medical bills and lost wages if you are unable to work.

Pursue Business Opportunities Actively

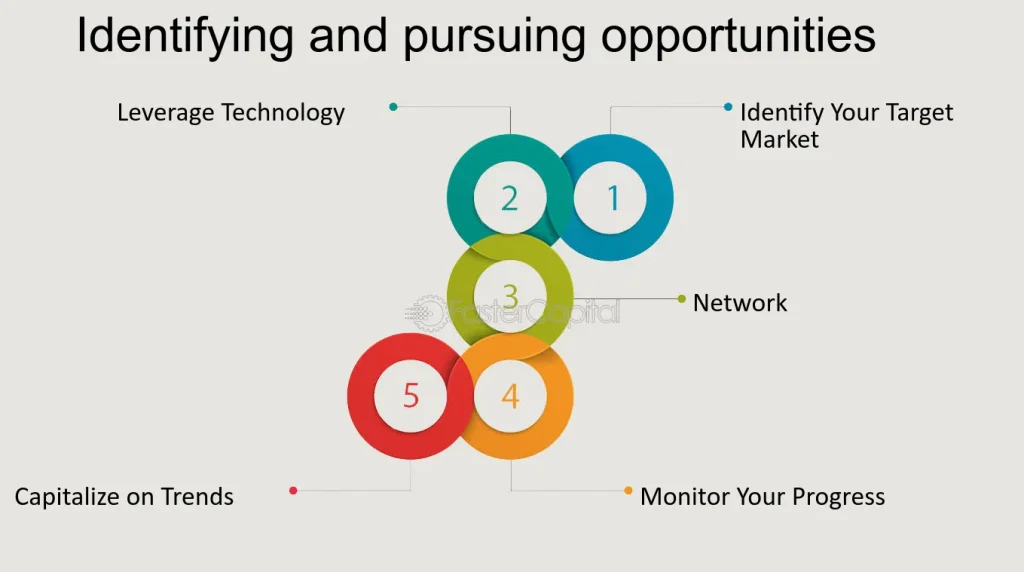

As self-employed, you do not work until work comes to you—work must come looking for you. Unlike a job where the work is given to you, self-employment requires venturing out to look for projects and clients.

Paying only for traditional modes of advertisement such as flyers and business cards can prove to be costly and ineffective. Instead, reach out to potential customers where they are most active. Online forums are the place to do so. Sites such as LinkedIn,Upwork, Fiverr, and industry-specific job boards can put you in touch with someone actively searching for the services you offer.

Networking is crucial as well. Go to conferences and other professional events, join online forums related to your profession, and post on social media sites to disseminate your information. Word-of-mouth is extremely effective, so always do great work and customer service to generate positive word-of-mouth recommendations and reviews.

Diversifying your sources of income is another strong tactic. If your primary source of income is project-based, diversify to passive sources of income, such as creating digital products, selling online courses, or affiliate marketing to supplement your income. The more sources of income you have, the more financial security you will have.

Hire an Accountant

One of the least used but best investments you can make as a freelance worker is to hire an accountant. Accounting, noting expenses, dealing with taxes, and staying in compliance with legal statutes can overwhelm you, especially if you are not necessarily mathematically gifted.

In contrast to regular employees whose taxes are withheld from their wages, self-employed workers are responsible for their own tax returns. This involves setting aside some of your earnings for tax payments, knowing what can be deducted, and keeping close records of every transaction.

An accountant can streamline this process for you. He or she will ensure you do not pay an excessive amount in taxes, walk you through what legal deductions you are not currently taking advantage of, and manage your books of account. A good accountant also provides you with strategic financial suggestions so you will be able to grow your company in a responsible way.

For those fearful of hiring an accountant due to the cost it takes, consider this: an experienced accountant often ends up saving you more money than they pay to work for in tax returns. And that feeling of tranquility they induce is priceless.

If employing a full-time accountant is not possible, think about utilizing accounting software such as QuickBooks, FreshBooks, or Xero to manage your income and expenses effectively. These programs automate most of the aspects of financial management and make tax time much less stressful.

Final Thoughts

Being an entrepreneur is a rewarding experience, but it comes with financial responsibilities that should not be ignored. Without the security and stability of ongoing employment, it is important to take active steps to safeguard your money.

By having a secure financial buffer, looking for active job prospects, and consulting the services of professional financial assistance, you can ready yourself for long-term success. Becoming self-employed is not an easy path with turns and bends along the way, but with the proper money skills in your arsenal, you can face it confidently and smoothly.