Your financial capacity depends heavily on your credit score because this score determines your chances of obtaining different kinds of credit and securing employment opportunities. It is possible to enhance your credit score within three months, and you should focus on the task because it will yield noticeable results. Proactive planning, together with the right steps, leads to quick credit score improvement. The following three-month process describes how you can start improving your credit score.

You Must Evaluate Your Credit Report Together With Your Score

Begin your credit fixing process by establishing what position your credit currently holds. It is essential to view your credit record to understand how to address its contents. Complete information about your current credit measurement makes all necessary transformations impossible.

Get Your Free Credit Report:

Proceed by obtaining your credit report at no cost. You maintain the right to receive complimentary credit reports each year from Equifax, Experian, and TransUnion, which are the three main credit agencies.

Before proceeding, review your credit report with your credit score included. You can get your credit score along with a breakdown of its influencing factors totally free using Credit Sesame and similar services. Your understanding of your score represents both motivation and allows you to follow your credit enhancement step by step during each month.

Check for Errors or Inaccuracies:

You should examine your credit report thoroughly after receiving it. The credit report discloses details about your credit accounts through the balances of each account, along with payment records, including collection accounts.

Errors, together with inaccurate information, appear more frequently than most people expect, which can damage your credit score negatively. Mismatched late payments together with accounts that you never opened and unfamiliar debts should be verified.

Discovering errors in your report will allow you to obtain credit bureau correction services. Reports with error corrections will automatically result in a faster increase in your credit score.

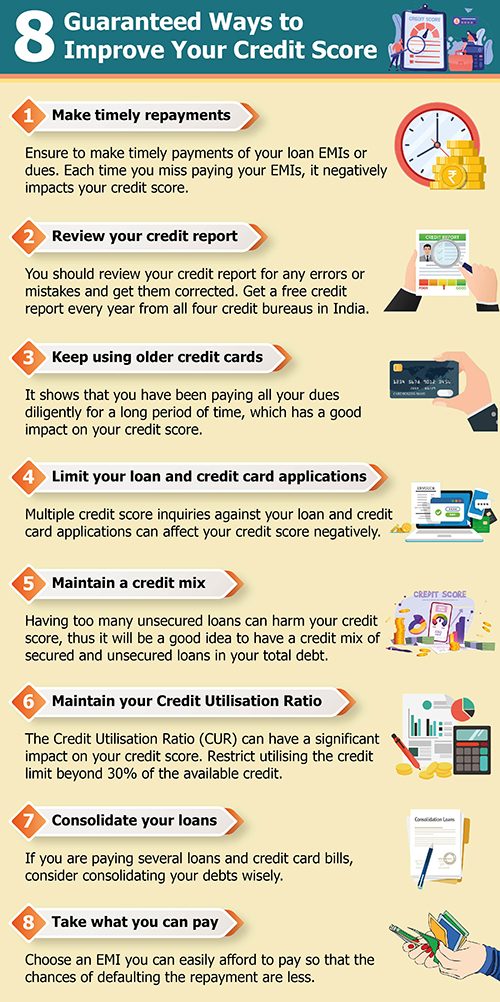

Concentrate on the important elements that determine your credit score. These include:

- Payment history: Your payment record holds the most weight in determining your score because it represents 35% of your total rating.

- Credit utilization: The amount of credit you utilize constitutes credit utilization. Your credit score health improves when your utilization ratio stays below 30%, yet the best results emerge from lower utilization ratios.

- Length of credit history: A longer time for your credit details to stay active on record will improve your credit score.

- Credit mix: Diverse credit accounts, such as loans, together with credit cards, contribute positively to your score.

- New credit: The opening of new credit accounts should be delayed until completely essential.

You should focus on dealing with the issues identified as credit score reducers to start improving your situation.

Pay Down Credit Card Balances

Employ the necessary steps to begin implementing your solutions once you complete your credit report evaluation and error analysis. Your credit score will grow rapidly when you lower the balances on your credit cards. Your credit score responds rapidly when you decrease high debt levels since credit utilization ranks as the next crucial scoring factor.

For this step, you must put all your energy toward reducing your credit card debt. Your priority should be the payment of the credit card, which offers the biggest balance-to-limit ratio.

For example, if you have a card with a $2,000 balance and a $2,500 limit, you are using 80% of your available credit, which will hurt your score. By paying that down to below 30% or, even better, below 10%, you will have an immediate, positive impact on your credit score.

Consider a Balance Transfer:

If you are struggling with high interest rates on your credit card, consider doing a balance transfer to a card with a 0% introductory APR. This can help you save money on interest while you pay down the balance. Just be sure to read the fine print and avoid incurring fees.

Keep Your Utilization Low:

The lower your credit utilization, the better your score will be. Aim to keep your credit card balances under 30% of your total credit limit. If possible, keep it under 10% to get the best results. This will show lenders that you are responsible for credit management.

Pay Off Medical Collections

If you have medical collections on your credit report, now is the time to address them. Medical debts can have a significant impact on your credit score, but they are treated differently from other types of collections. Under the new scoring models, paid medical collections no longer affect your score.

Settle Your Medical Collections:

If you have any unpaid medical collections, contact the provider to either pay them off in full or negotiate a settlement. Once you pay off or settle the debt, the collection will no longer hurt your credit score. In fact, if it was paid, it may be removed from your report entirely.

Understand Your Rights:

If the collection agency does not remove the account after it is paid, you have the right to ask for a pay for delete” agreement, where they remove the account from your report once it is settled. Keep in mind that not all collection agencies will agree to this, but it is worth asking.

Conclusion

Tracking your progress is essential as you work to improve your credit score. Sign up for a free credit monitoring service so you can see how your actions are impacting your score month by month. Many services, like Credit Karma, provide access to your credit score and offer alerts whenever there are changes to your credit report.

The more you monitor your progress, the more motivated you will be to continue working towards your goal. By making these strategic changes and monitoring your results, you will be well on your way to seeing a noticeable improvement in your credit score within just 90 days.