Running a business is like a tightrope at times, particularly with money. Waiting to get paid for too long is one of the largest issues most businesses have. The money does not appear immediately, yet you have already done the work or sold your product. This complicates paying bills, meeting day-to-day expenses, or even expanding your business. Invoice financing can be of great help there.

Throughout this blog, we will discuss the meaning of invoice financing, the importance of invoice financing, and how you can use invoice financing to transform unpaid invoices into a continuous flow of cash to your business.

What is Invoice Financing?

Think of a scenario in which you forward an invoice to a customer requesting payment. Usually, you would have to wait 30, 60, or even 90 days before you receive the money. That is a long wait when you are in need of money today.

With invoice financing, you do not have to wait. You instead borrow money on your unpaid invoices through a finance company. Consider it as borrowing from money that you already have. When your customer eventually pays the invoice, you settle the finance company.

This provides fast access to cash, thus enabling you to operate your business efficiently.

Why is Invoice Financing Important?

The bloodline of any business is the cash flow. The reason why many companies fail is not due to failure to make sales, but due to the fact that their money is stored up in unpaid invoices. It is difficult to pay people, purchase materials, or invest in development without cash at hand.

This is solved by invoice financing. You do not have to wait weeks or months before you receive payment, but you get money instantly. This will assist you in paying your bills, remaining afloat, and even capturing new business opportunities.

The Top Benefits of Invoice Financing

Running a business is fun, and at times, money can be an issue. Delayed payment is one of the greatest problems for many business owners. You issue invoices, yet the customers take weeks or months to pay. This may delay your plans and render it difficult to meet day-to-day expenses. That is where invoice financing comes in.

Invoice financing is a smart way to turn unpaid invoices into quick cash. Instead of waiting around, you get the money up front and keep your business moving. Let’s break down the top benefits and see why it can be a great choice for your business.

1. Quick Access to Cash

The best part about invoice financing is how fast it works. You are able to acquire the cash due on your invoices in 24-48 hours. That is much faster than waiting until customers pay or undergoing the agony of a lengthy bank loan procedure. Quick cash will help you pay bills, maintain smooth operations, and will never leave you short of money when you need it the most.

2. Better Cash Flow for Growth

Good cash flow keeps a business healthy. The invoice financing ensures you are not left waiting to get paid. Rather, you are never short of finances to meet expenses. The predictable cash flow will allow you to make plans more effectively, deal with slow-paying clients, and concentrate on growth rather than worry about outstanding payments.

3. No Extra Collateral Needed

Most loans ask for assets like property as security, but invoice financing does not. Your unpaid invoices themselves act as collateral. This is great for small or new businesses that do not own a lot of assets. You can get the funds you need without risking your property or other valuables.

4. Flexibility to Spend the Money

Another big benefit is freedom. With invoice financing, you decide how to use the money. Need to hire staff? Buy equipment? Stock up on products? Cover anemergency expense? It is your call. This flexibility helps you handle whatever is most important for your business at the moment.

5. Grows with Your Business

The more your business sells, the more invoices you will have and the more money you can access. Unlike loans, where you reapply every time, invoice financing grows with you. As your sales increase, your available funds increase too. That means your cash flow always keeps up with your growth.

6. Keep Full Control of Your Business

Some types of funding make you give up ownership or control. With invoice financing, that is not the case. You stay in charge of your company, and in many cases, you still handle your customer relationships directly. This way, you get the cash you need without giving up part of your business.

7. Easier Approval than Bank Loans

Banks often care a lot about your credit score. But with invoice financing, what matters most is whether your customers pay their invoices. That makes it easier for businesses with credit issues or those who do not want to deal with strict bank requirements to qualify.

8. Extra Help with Managing Invoices

Some invoice financing companies also help track and manage customer payments. It implies that you do not need to waste so much time pursuing overdue invoices. Rather, you can get down to business and develop your business with professionals doing the paperwork.

How Invoice Financing Works: A Simple Example

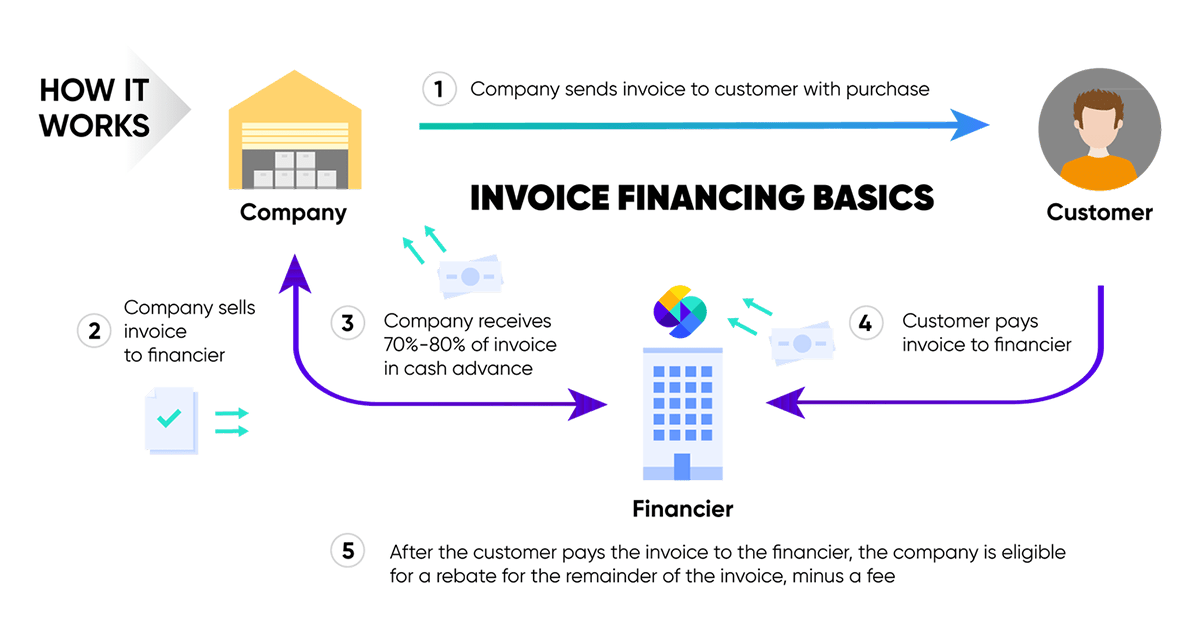

Imagine you run a business and sell goods worth $10,000. You send an invoice to your customer, but they take 60 days to pay. Normally, you would have to wait two months to get your money.

With invoice financing, you can get cash much faster. Here is how it works: you take your $10,000 invoice to a finance company. They may pay you 85 percent of all that out-of-pocket, in a day or two. As soon as your customer makes the payment, you will get the other $1,500, less a small fee to the finance company.

This way, your non-paying invoice turns into cash instantly, and this will make sure that your business operates without any delays.

Who Can Benefit from Invoice Financing?

Invoice financing is great for many types of businesses, especially if they:

- Have customers who pay slowly or have long payment terms

- Experience seasonal sales or ups and downs in cash flow

- Want to grow quickly but need extra working capital

- Are small or new businesses without much collateral

- Prefer to avoid long bank loans or giving away ownership

Tips for Success with Invoice Financing

To make the most of invoice financing:

- Check your customers’ payment history – Businesses with reliable customers get the best rates.

- Know the costs– It is better to understand the charges and fees before enrolling.

- Invest the money well -Do not only use the money on settling old debts.

- Keep clear records – Track invoices and payments carefully for smooth operations.

Conclusion

Invoice financing is an intelligent, quick, and adaptable method to convert unpaid invoices into cash. It allows businesses to access the earned profits without having to wait until customers pay to access the money. With invoices as collateral, you get to keep your business running, easily manage cash flow, and even grow faster.

Invoice financing is a straightforward solution to the issue of slowing down business or experiencing stress in situations where waiting too long to collect payments slows the business or results in stress.