Do you recall the time when planning personal finances involved stacks of documents, midnight math problems, and maybe a yearly visit to an advisor? All this is quickly becoming history!

AI is taking over and rewriting the rules of managing one’s personal finances, from daily budgeting to long-term investment strategies.

It is not a matter of AI advancing, but clever technology offering personal financial planning in greater numbers, customized, and simplified than ever before.

So, how is this really happening?

The Rise of the AI in Personal Financial Planning

You have probably heard of “robo-advisors,” or Chatbots, those computer-programmed platforms that manage your investing for you. They were the first wave of AI in finance, and they have already brought investing to a lower cost and convenience level for many. But AI is much more sophisticated than picking stocks.

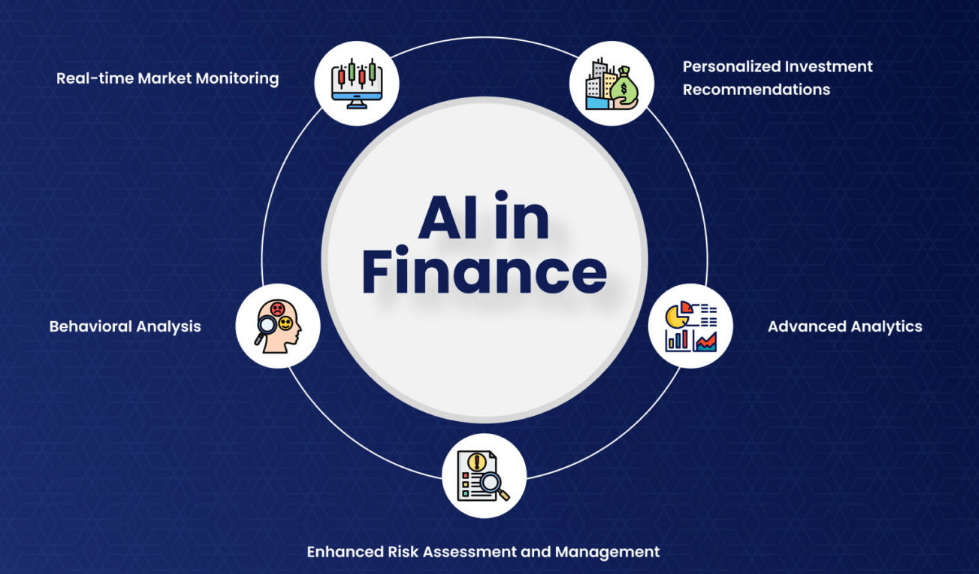

Today’s AI financial advisor software is becoming highly sophisticated. They can:

Process large data in seconds: Imagine digging up years’ worth of market history, economic indicators, and your individual spending patterns. A human advisor never would, but AI can immediately, discover subtlety and nuance that even the keenest human eye would miss. The result is wiser, more timely advice.

Offer truly individualized plans: Eliminate the generic advice. An AI-powered system of financial planning can search your unique financial picture – your income, expenses, debts, savings, goals (like buying a home or retiring early), and even your tolerance for risk – to generate an individualized plan created especially for you. It is having your own personal mind in finance always working in your favor.

Provide instant feedback and adjustments: Life changes, and so should your budget. AI can continue to monitor your accounts and the market and alert you to issues or opportunities. If the market varies, or you receive an unexpected bill, your AI money advisor will suggest adjustments to remain on track.

Get to know the AI Investment Advisor: Investing used to look intimidating, something for the high-net-worth or finance magazine aficionados. Not anymore! AI investment advisor websites are bringing intelligent investing to the masses.

The AI Investment Advisor: Smart Investing for Everyone

AI investment advisor websites can:

Automate portfolio management: AI will automatically rebalance your portfolio for you, keeping your asset allocation according to your goals and risk tolerance without you lifting a finger.

Hidden risk and opportunity: Since AI is always watching the market, it will warn you about hidden risks to your investments or discover new opportunities that align with your economic purposes.

Help with tax-loss harvesting: Sounds scary, but essentially, it is the process of selling an investment that is losing money so you can utilize capital gains and reduce your tax burden. AI can easily locate these opportunities, earning you money.

Will AI Replace Human Financial Advisors?

Now you might be asking, “Is AI going to take the place of my new financial advisor?” The quick answer is no because it is unlikely. Whereas data analysis, automation, and pattern recognition can be performed by AI much better than by other humans, the same simple human touch that often proves key to financial advising is still lacking there.

Think about it:

Empathy and understanding: A human advisor will be able to understand your fear of money, celebrate your financial successes, and provide emotional comfort during challenging times. AI as clever as it is can not actually be empathetic.

Complex life circumstances: Life decisions like having children, going through a divorce, or caring for aging parents entail numerous complex emotional and financial concerns that must be addressed by an advanced human navigator.

Building trust: Personal monetary decisions are personal. People generally wish to build a rapport with a flesh-and-blood person they can trust, someone who can simplify jargon and serve as a sounding board for their financial goals and stress.

The future of money guidance is a strong collaboration. The AI tools will be employed by the financial advisers to perform the heavy lifting – the data crunching, the drudge work, and the initial plan creation.

That will leave them free to do what they do best: building relations, providing customized strategic advice for complex situations, and bringing that all-important emotional insight and reassurance.

Future of AI-Driven Financial Planning

Fundamentally, AI is not about replacing humans but about augmenting them. It is taking financial advice and making it faster, more accurate, and accessible to more.

Regardless of whether you are an investor or just getting started in creating your own financial future, the arrival of the AI financial advisormeans you have more information and capabilities at your fingertips than ever before.

So do not let the future scare you. Ask your current advisor what they are working on with AI, or experiment with some of the fantastic AI-driven financial planning tools available. The future of managing money is smarter, and you can reap the rewards!