As more people find eCommerce convenient, many business owners are on the receiving end of dishonest customers. Through illegitimate chargebacks, many businesses lose out on potential revenues. Learn more about fraud chargeback and the steps you can take to prevent it.

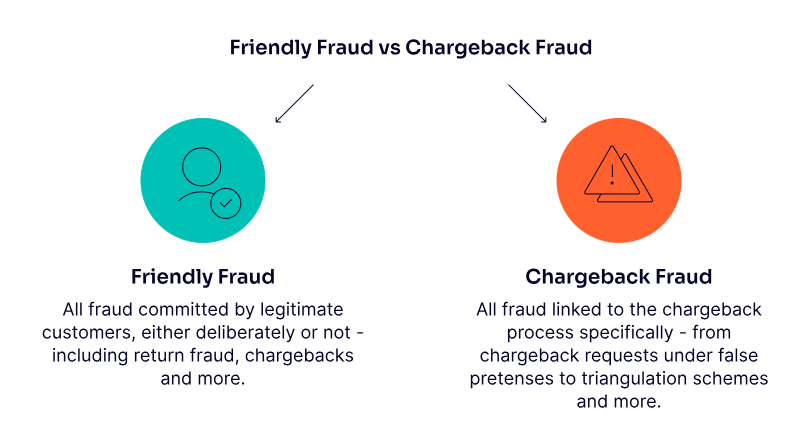

What is Friendly Fraud?

A customer may dispute a transaction based on various reasons. However, not all chargebacks filed by customers are legitimate. Three major types of fraud can lead to chargebacks:

- Legitimate disputes

- Friendly fraud

- Criminal fraud

Criminal fraud involves using stolen credit card numbers to make purchases. Although not a type of fraud, legitimate disputes also lead to chargebacks. This happens when a customer has legitimate grounds for filing a chargeback, such as receiving different goods from what they purchased online.

Friendly fraud occurs when a customer makes a genuine purchase but does not recognize the charge in their bank statement. It may seem accidental, but not all friendly fraud is accidental. Common reasons for fraudulent chargebacks include:

- The buyer no longer wants the purchased product but does not want to inform the merchant

- The buyer did not understand the purchase process

- A family member used the cardholder’s information for purchases without notifying the owner of the card

- The buyer hoped to get goods for free

Overall, when the buyer disputes a transaction with their bank without contacting the merchant, it is considered friendly fraud, especially if the intention is to get something for free. Essentially, the buyer abuses the chargeback process to obtain goods for free.

What is Chargeback Fraud?

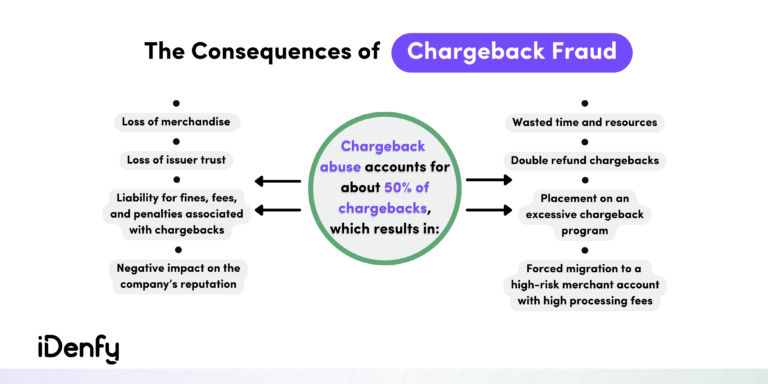

Chargeback fraud occurs when a chargeback is submitted for a transaction that the cardholder made. A merchant has the option to contest the chargeback procedure if they believe it was misused. Nevertheless, there are a number of issues associated with disputing a chargeback, such as drawn-out procedures and high processing costs. Occasionally, retailers elect to pay the chargeback because they believe the disadvantages exceed the benefits.

There are two possible outcomes for a chargeback:

- After becoming a victim of fraud, the client submitted a request to have the money that was taken returned after seeing an unusual transaction on their credit card.

- The consumer chose to submit a chargeback even though they had made a valid transaction.

E-commerce companies continually have to strike a balance between the requirement to prevent card-not-present (CNP) fraud and the demands of providing a seamless checkout process and accepting the greatest number of legitimate purchases. Chargeback abuse, which happens only after the transaction is done and outside of the buying process, adds even more difficulty.

How Chargeback Fraud Happens

Chargebacks are the way through which the concerned customer may dispute unauthorized transactions with banks instead of directly with the concerned merchant. Under the federal law, there are three legal ways of credit card disputes:

- When a credit card is used without authorization, it is called unauthorized usage.

- Billing mistakes occur when a business bills a customer for a product they did not get or mistakenly charges them.

- The right to refuse payment in cases when a consumer has tried to resolve a problem with the merchant but has not been successful.

However, sometimes, consumers abuse these protections to get a refund from merchants in situations where they are not entitled to it. Merchants are allowed to file a counter-dispute in those instances.

Some of the most common reasons consumers file chargebacks include never receiving an item, one transaction being unauthorized, or the service continuing to charge them after they try to cancel.

But perhaps the actual reason the buyer may be giving is something else; maybe he would like to hold onto an item without having to pay for it, maybe he regrets making a purchase, maybe he returned it too late, or maybe he just forgot to remember the item.

Causes of Chargeback and Preventions

Chargebacks may occur for a number of reasons. Here are some of the most prevalent causes:

-

Fraud

Fraud is a major source of chargebacks. When someone is billed for a purchase they did not make, this occurs. This may be avoided by using secure payment methods like EMV chip cards.

Another type of fraud is “friendly fraud,” in which a client makes a valid transaction but thereafter disputes the charge. They can declare they did not receive the goods or that they were defective, even though that’s not true.

-

Unhappiness with Customers

Instead of contacting the company, a dissatisfied client may choose to request a refund via their bank. According to statistics, only one in twenty buyers will take their complaints to the vendor directly. The others may start a chargeback.

To avoid this, firms should clearly disclose their return policies and establish an open line of communication with customers to settle difficulties early.

-

Technical Problems

Technical issues, such as an expired credit card, a website bug, or a consumer mistakenly picking something at checkout, can occasionally result in chargebacks.

Businesses should employ dependable e-commerce solutions that guarantee an easy checkout experience to reduce these mishaps. For example, Shop Pay systems make things easy and clear for customers.

-

Problems with Shipping

Chargebacks could also happen if a client says they never got their order. The reason for chargebacks pertaining to missed delivery is about 26%.

Businesses should employ shipping companies that give tracking numbers and evidence of delivery to avoid this. By providing choices like curbside pickup, local clients can lower their chance of experiencing shipment issues.

-

Unknown Company Name

Chargebacks may result from a company using a name that differs from what is listed in-store or on its website and confuses customers.

To avoid this, businesses could use email confirmations or comments on their website to notify clients about how their costs will appear on statements.

Preventing Chargeback Frauds

Any chargeback can damage your business. The following steps will help you prevent friendly fraud in your business.

-

Implement Digital Fraud Solutions

A digital fraud tool can prevent fraud before it happens. These tools make it possible to stop any suspicious transactions. Ethoca chargeback solutions include using these tools to help you discover trends that lead to chargebacks. Find a good solution provider to help you uncover the trends.

-

Good Customer Service

To avoid legitimate chargebacks by disappointed customers, you should train your staff to respond to customer issues quickly. Good customer service can prevent friendly chargebacks that arise from customer confusion.

Additional steps you can take to prevent friendly fraud include

- Advertising that matches products

- Maintaining a blacklist

- Keeping accurate data

- Offering refunds

-

React promptly

There are deadlines for chargeback answers, and if you take too long to reply, you would not have any more choices. Get your facts together and react to the chargeback as soon as possible. But not so hastily that you neglect information. Allow enough time to be meticulous.

-

Speak with the customer.

Beyond what the bank or card issuer informs you in the chargeback letter, try to figure out what is wrong and find out more information. Maintain a cordial chat, and report the exchange to the bank or card issuer along with your documents. Ensure to include any pertinent details the consumer provided to bolster your argument.

-

Prove your point

Merchants might compose a reply letter for a chargeback. If you have the time, write a letter outlining your proof for both the valid charge and the fraudulent chargeback. Speak professionally and back up your claims with screenshots and images.

-

Monitor Shipments

If you use tools and services that track shipments and indicate when a product is delivered, you have greater power to contest a chargeback when a customer claims that a product was not delivered.

-

Make Returning Products Simple

Extending your return window may make it easier to return things for a refund. If customers are aware that they may still return an item rather than phoning their credit card provider after a brief time has passed, they may be more willing to cooperate with you. Facilitating the process may also involve replying to disgruntled consumers and making communication channels easily accessible.

Conclusion

There is nothing friendly about friendly fraud. Your business will still lose money and sometimes the product, too. Implement the recommended steps to ensure your business is immune to these types of chargeback disputes.