Every year, millions of people get their personal and financial information stolen by cyber criminals and hackers. These thieves are always finding new ways of stealing financial information, so you must be careful. Even though law enforcement tries their best to catch them, you can also defend yourself. Below are some of the most vital tips to secure your financial information online.

Keep Your Passwords Secret

One of the greatest blunders one makes is recording passwords and putting them where anyone else can pick them up. Others store banking passwords on Post-it notes in front of the computer or in their phone’s notes application. It is unsafe since anyone finding them can open your accounts.

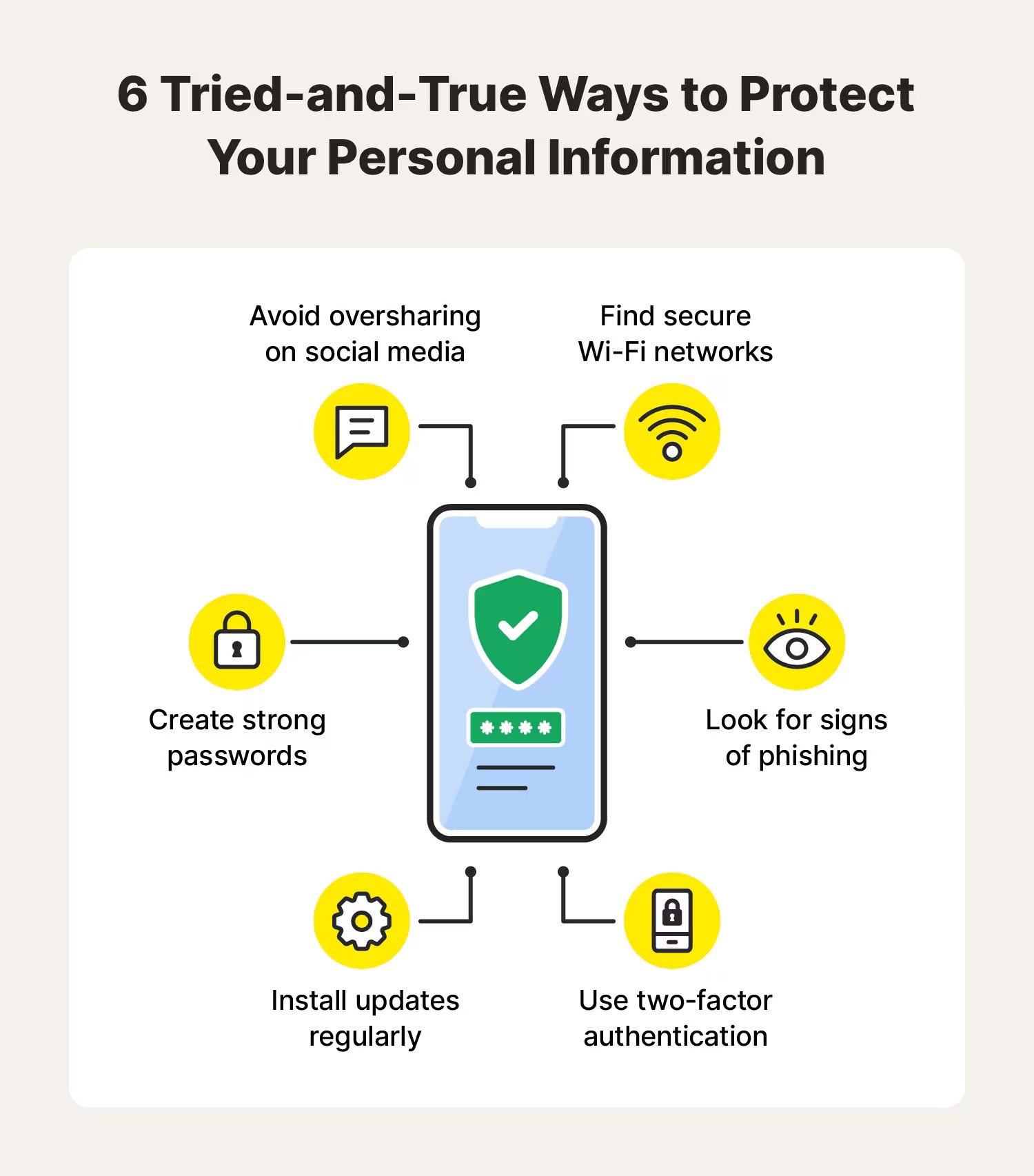

Rather, try these safer measures:

- Remember your passwords – If you have to record them, do so in a locked drawer or safe.

- Use a password manager – Software like LastPass, Bitwarden, or 1Passwordstores passwords securely without having to remember them all.

- Do not share passwords – Even with family or friends, sharing passwords makes theft more likely.

Change Your Passwords Regularly

Most individuals use a single password for multiple accounts because it is easier to remember. But if one hacker has one password, they can access all your accounts. To be safe:

- Change passwords every few months – It becomes harder for hackers to enter.

- Have strong, distinct passwords – A good password has a combination of both capital and lowercase letters, numbers, and symbols (like B3$af3P@ss).

- Enable two-factor authentication (2FA) – Banks and websites use 2FA, which requires a code that has been sent to your phone in addition to your password.

Employ Secure Internet Connections Only

Public Wi-Fi in a coffee shop, mall, or airport is convenient but insecure for shopping or banking. It is just too easy for hackers to steal data from networks that are not password-protected. To protect yourself:

- Use your phone’s data – If you need to check your bank account, use your phone’s data rather than public WiFi.

- Use a Virtual Private Network (VPN) – A VPN encrypts your internet, so hackers have a harder time listening to you.

- Do not log into sensitive accounts on library or hotel computers – Public computers could be loaded with malware that records what you type.

Daily Check Your Accounts

Similar to checking your email daily, you should also regularly check your credit and bank cards. Fraud discovery beforehand can save you from significant losses. How to check:

- Install bank alerts – Banks will usually permit you to receive text or email alerts on large transactions.

- Carefully review statements – Look for small, unusual charges—some fraudsters test accounts by trying them out with small purchases before making large transactions.

- Report suspicious activity right away – If you see something out of place, report it to your bank right away.

Shred Personal Documents

Unused bank statements, financial information, bills, and credit card solicitations hold personal information that identity thieves can use. Instead of throwing them in the trash:

- Use a shredder – Cross-cut shredders make documents unreadable.

- Go paperless – Switch to electronic statements to avoid the possibility of physical theft.

- Handle mail with caution – When you get financial mail, do not leave it in your mailbox for long.

Handle Emails and Links with Caution

Spammers will send fake emails on behalf of banks, Amazon, or PayPal. They are phishing emails that make individuals give passwords or download viruses. To avoid scams:

- Do not open questionable links – If an email looks suspicious, visit the company’s website instead of clicking on the link.

- Confirm the email address of the sender – Spammers often employ addresses that look identical to genuine addresses (like support@paypa1.com instead of support@paypal.com).

- Never give away personal details by email – Genuine companies will never ask for passwords or Social Security numbers by email.

Protect Your Devices

Hackers may target your tablet, computer, or phone. Safeguard your financial information by these cost-effective ways:

- Keeping software up-to-date – Updates in software usually come with security against viruses and hacking attacks.

- Applying antivirus software – Software such as Norton or McAfee can stop malware.

- Securing your devices – Use a passcode, fingerprint, or face ID to keep them out of unwanted hands.

Freeze Your Credit if Necessary

You can freeze your credit if you think your identity has been stolen. It bars the criminals from opening new accounts using your name. The three major credit reporting agencies (Equifax, Experian, and TransUnion) provide free credit freezes.

Advanced Measures to Safeguard Your Financial Data

1. Check and Revise Privacy Settings from Time to Time

Check and revise the privacy settings on each of your electronic devices, software programs, and internet accounts periodically. Modify settings to limit data sharing and restrict access to personal information. This anticipatory step minimizes exposure to potential threats.

2. Encrypt Personal Financial Records

Ensure that all sensitive financial information, such as tax returns, invoices, and bank statements, is encrypted when stored digitally. Encryption adds a layer of security, as it is more difficult for hackers to access your data.

3. Be Careful When Using Public Wi-Fi Networks

Avoid using public Wi-Fi to access personal financial information since it is usually not encrypted and vulnerable to cyberattacks. In case of need, use a reputable Virtual Private Network (VPN) to secure your connection and make sure your data can not be intercepted by potential spies.

4. Educate Yourself on Upcoming Cyber Threats

Cybercriminals are also updating their strategies continuously. Remain aware of the latest cybersecurity attacks, such as phishing attacks and malware infections, by keeping track of reputable news media sources and cybersecurity websites. Information is a powerful shield against future intrusions.

5. Employ Multi-Factor Authentication (MFA)

Implement MFA on all accounts that offer it, especially those that have anything to do with finances. MFA adds an additional verification stage, and this prevents hackers from getting into your accounts much more efficiently.

6. Monitor Your Financial Accounts

Regularly check your bank and credit card statements for any unusual transactions. Early detection of suspicious activity allows for instant action, which can prevent loss of money.

Final Thoughts

It requires caution to protect your online financial information. By being cautious in these ways—protecting passwords, avoiding public Wi-Fi, monitoring accounts, and being cautious with emails—you can greatly reduce the risk of fraud.

Cyber thieves always evolve their scams, but being aware and watchful will safeguard your money and identity.

Remember: The longer you take to protect yourself, the harder it will be for criminals to steal from you. Be alert and make online safety a habit of everyday practice!