As an entrepreneur, you already have countless responsibilities, from managing staff to running operations. One of the most complicated and time-consuming activities is payroll. Paying employees on time and correctly, paying taxes, and staying within compliance with the law can get overwhelming. The good news is that by hiring a professional payroll service, you can lift this weight off your shoulders and keep your focus on expanding your business.

If you are contemplating payroll outsourcing, here is all you should know about outsourcing to the right service provider.

Understanding the Payroll Process

Payroll is not merely paying employees—it is a complex process involving careful financial record-keeping and adherence to tax regulations. The following are key steps involved in processing payroll:

- Calculating Employee Earnings – Salaries, hourly rates, overtime, bonuses, and deductions need to be tallied.

- Tax and Deduction Administration – Withholdings for income tax, social security, retirement contributions, and health benefits must be properly calculated.

- Making Payments – Paying employees their wages in a timely manner, either through direct deposit or checks.

- Reporting and Paying Taxes – Companies are required to file payroll taxes with federal, state, and local governments.

- Record Keeping – Keeping accurate and organized payroll records for tax and audit purposes.

With all the moving pieces involved, a professional payroll service can assist you with these tasks effectively, minimizing errors and compliance issues.

Things to Keep in Mind Prior to Engaging a Payroll Service

Prior to outsourcing your payroll, you need to evaluate your business requirements and expectations. The following are essential points to evaluate:

What Services Do You Need?

Some companies just require plain payroll processing, while others demand full-service payroll, such as tax filing, benefits administration, and compliance assistance. Ask yourself:

- Do I require support with payroll taxes and compliance?

- Will my payroll solution manage employee benefits and deductions?

- Do I require an integrated system with my accounting software?

By knowing your requirements, you can select a provider that best fits your business model.

Working with Contractors vs. Employees

If you have mainly independent contractors versus full-time staff, your payroll requirements will vary. Contractors themselves take care of taxes, and companies do not deduct payroll taxes from their fees.

Key Features to Consider When Choosing a Payroll Service Provider

After you have determined your payroll requirements, assess potential providers based on the following characteristics:

Good Customer Support

Payroll mistakes are expensive and frustrating. A good payroll provider that has good customer support will be able to promptly resolve any problem. Ensure you find a provider that provides:

- Several communication mediums (phone, chat, email)

- A specific account manager for one-on-one support

Clear Pricing

Hidden charges can be a significant disadvantage of outsourcing payroll. When negotiating fees, request an explicit breakdown of fees, such as:

- Base subscription fee

- Per-employee fees

- Extra service fees (e.g., tax filing, direct deposit, reporting tools)

A clear provider will provide you with a simple pricing model, preventing you from incurring surprise expenses.

Scalability

Your payroll needs today may not be the same in a year. Choose a payroll provider that can scale with your business growth. Key considerations include:

- The ability to add new employees seamlessly

- Support for multiple payment structures (salaries, hourly wages, commissions)

- Integration with HR and accounting systems

- A flexible payroll provider will accommodate your evolving needs, ensuring a smooth transition as your business expands.

Testing the Waters: Free Trials and Demos

Most payroll service providers provide free trials or demo versions of their software. Use these to test:

- Ease of use

- Integration capabilities

- Reporting and analytics features

- Overall functionality

A trial period enables you to see whether a payroll provider meets your operational requirements before committing long-term.

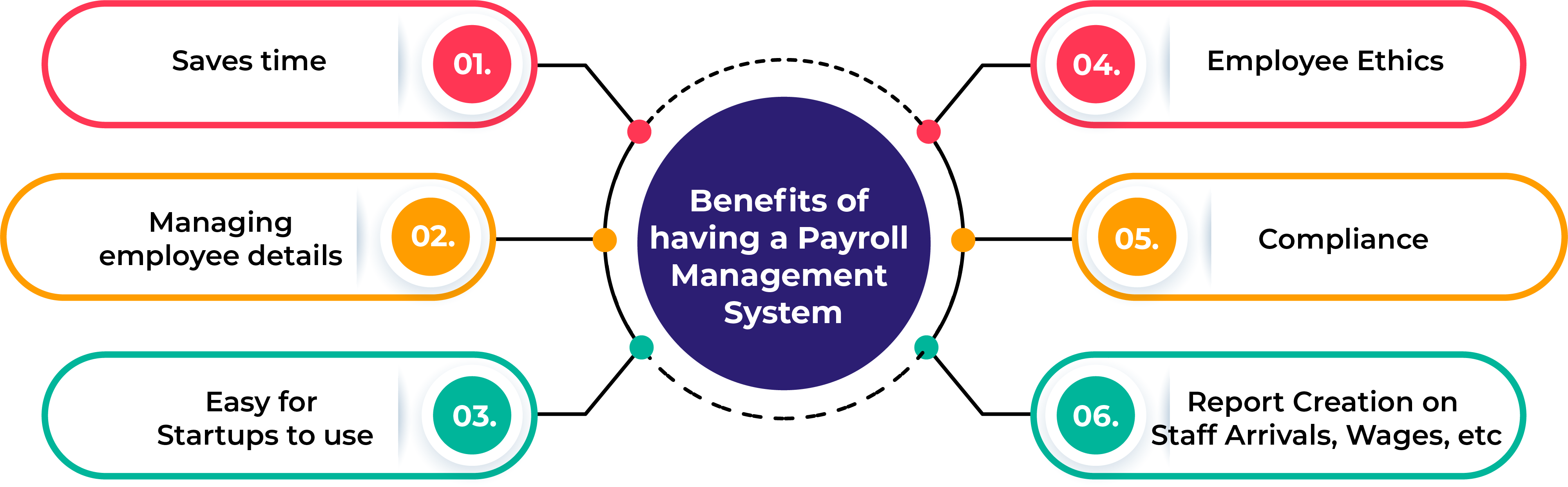

The Advantages of Employing a Payroll Professional

Payroll outsourcing has a number of benefits, including:

- Time Savings – Release precious hours spent on administrative work.

- Compliance Assurance – Minimize tax penalty and error risk.

- Employee Satisfaction – Pay employees on time and accurately, enhancing employee satisfaction.

- Improved Security – Safeguard sensitive payroll information with secure technology.

Final Thoughts

Contracting with a professional payroll provider is an investment in efficiency, accuracy, and peace of mind. By choosing a provider that meets your unique requirements, provides clear pricing, and has great customer support, you can optimize payroll management and concentrate on building your business.

Prior to making a decision, do your research, ask for demos, and compare pricing models. The proper payroll service will not only do your payroll work but also help your business thrive in the long run.