With the population continuing to bloom, there has been a rising need for urban development by companies like the one run by CEO Aubrey Ferrao. Land development services like those provided by Aubrey Ferrao are in demand. However, many of the residential areas coming into being have as many rental properties as homeowners.

This is because a large portion of both millennials and older generations prefer to rent. Why is this, you may ask? Well, as great as home ownership is, renting does come with some distinct benefits.

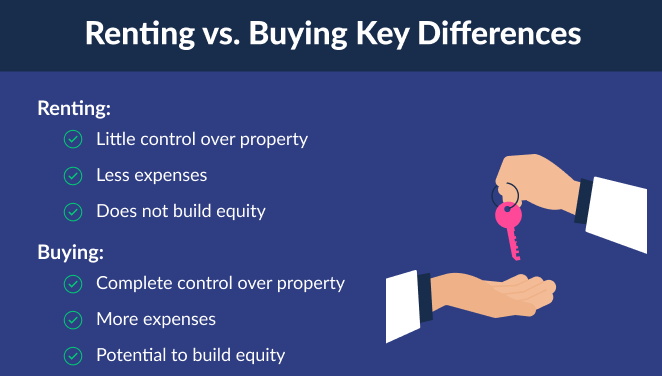

11 Advantages of Renting Over Buying

Lower Financial Investment

Renting a home does not require a large down payment. While a security deposit may be required, this money may be recovered upon leaving if you take care not to cause undue damage. It is also generally considerably less than a down payment, which is often equal to a large percentage of the building’s full purchase cost. Another advantage of renting is the lack of property taxes, which can also represent a sizeable expense. Furthermore, as renters are not responsible for maintenance and repairs, they are also free of costs for upkeep. Renter’s insurance is also cheaper than homeowner’s insurance.

Less Responsibility

Overall, renting is less stressful because the responsibility for things like maintenance and keeping property value up falls on the owner rather than you. There is no homeowner’s association to deal with and no mortgage to worry about. Amenities like a gym or pool are also often provided without the associated cost and worries of installation and care.

More Flexibility

There is also vastly more flexibility. Once your lease is up, it is easier to relocate as you wish and downsize if you need to or want to. You do not have to wait until you can find a buyer for your home or go through the hassle of putting it up for sale.

Both renting and home ownership possess many positives. These are not the only good points of renting; fewer responsibilities, a decrease in the funds required for living, and greater flexibility are appealing to many.

No Upkeep Fees or Repair Bills

The absence of maintenance and repair expenses is one advantage of renting a house. This implies that your landlord has complete responsibility for all upkeep, repairs, and improvements when you rent a home.

If an appliance breaks down or your roof leaks, you must call your landlord to get it fixed or replaced.

Conversely, homeowners are responsible for all expenditures associated with house upkeep, remodeling, and repair.

No Property Taxes

Not having to pay property taxes is one of the main advantages of renting as opposed to buying. Homeowners may have to pay substantial real estate taxes, which differ by jurisdiction. In certain regions, property taxes can cost upwards of thousands of dollars annually.

Property tax computations are based on the projected property worth of the house and the area of land it is constructed on, even though they might be complicated.

Property taxes may be a major financial burden for homeowners when new development grows in size.

Absence of a down payment

The upfront expense is another area where renters benefit monetarily more. Typically, a security deposit equivalent to one month’s rent is required of renters. And that is the norm as well. If they have not harmed the rented property, they should presumably get their money back when they go.

When buying a home with a mortgage, you must have a substantial down payment, usually 20% of the property’s worth.

Naturally, making a down payment improves the home’s equity, which only rises as the mortgage is ultimately paid off. Additionally, you have a worthwhile investment that renters can never have until you buy a property outright.

Few Fears of Property Value Declining

The value of real estate fluctuates. Renters are impacted by this far less, if at all, than homeowners, who may be greatly impacted. Both the amount of your mortgage and your property taxes may be impacted by the value of your home. Renters might not suffer as much as homeowners do in a difficult property market.

Adaptability to Downsize

When their lease expires, tenants have the choice to move to a smaller, more economical apartment. This type of flexibility is crucial for retirees who prefer a smaller, more affordable option that fits their budget.

Because of all the costs associated with purchasing and selling a property, it is far harder to escape a costly residence. Furthermore, a homeowner may not be able to afford to sell and move if they have made large remodeling expenditures and the selling price does not reimburse them.

Set Rent Amount

For the duration of the lease, the amount of rent you pay is set. Landlords have the right to increase rent at any time, but since you know how much rent you have to pay, you can budget more effectively.

This also holds for homeowners who have fixed-rate mortgages, which permit effective budgeting.

However, the interest rates on adjustable-rate mortgages (ARMs) can change, which frequently means that mortgage payments will go up.

Another factor that might drive up expenses for homeowners but has no bearing on renters is property taxes.

Reduced Utility Bills

Homes are usually bigger than rented flats; however, they can vary in size. Thus, they can have higher electric bills and be more expensive to heat. Compared to many residences, rental properties often have more compact and efficient floor plans, which lowers their heating and electricity costs.

Reduced Costs of Insurance

Renters need to keep a renter’s insurance policy, whereas homeowners must maintain a homeowners insurance policy. This type of coverage is far less expensive and will cover almost anything you possess, including jewels, laptops, and furnishings. According to an Insurance Information Institute research, the average annual cost of a homeowner’s insurance policy is $1,249, while a renter’s insurance costs $179.

Conclusion

Since they build up equity in their property, homeowners may benefit in the long term from owning a house. When it comes to years of rental payments, tenants have nothing material to show for it. Nonetheless, renting could be a preferable choice for people who wish to avoid the inconveniences of homeownership, maintenance expenses, and property taxes. It naturally relies on a person’s lifestyle, financial status, monthly rent payment capacity, and whether or not they are employed.