Whether it is a surprise medical bill, a surprise home repair, or simply owing money until you get your next paycheck, a cash advance can be a lifeline. Offered by credit card issuers and other financial institutions, cash advances allow you to get money in your hand immediately, but with their own terms.

Although cash advances are convenient to secure, they become unnecessary financial pressures if misused. That is why you have to know how to use them effectively. Listed below are five tips that will lead you to maximize your use of cash advances without compromising your finances.

Spend Wisely: Borrow Only What You Need

A cash advance is a lifesaver in times of emergency, but you should use it for the right purpose. Because cash advances have high-interest charges and fees, you should only take what you really need and not use it for discretionary spending.

Some good uses of a cash advance are:

- For paying immediate medical expenses

- For paying rent or mortgage to prevent penalties

- For paying for unexpected car repairs

- For paying emergency travel costs

Using a cash advance for unnecessary expenses, such as shopping, dining out, or entertainment, can lead to financial stress. Always keep in mind that a cash advance is not free money—it is a loan that must be repaid, often with interest.

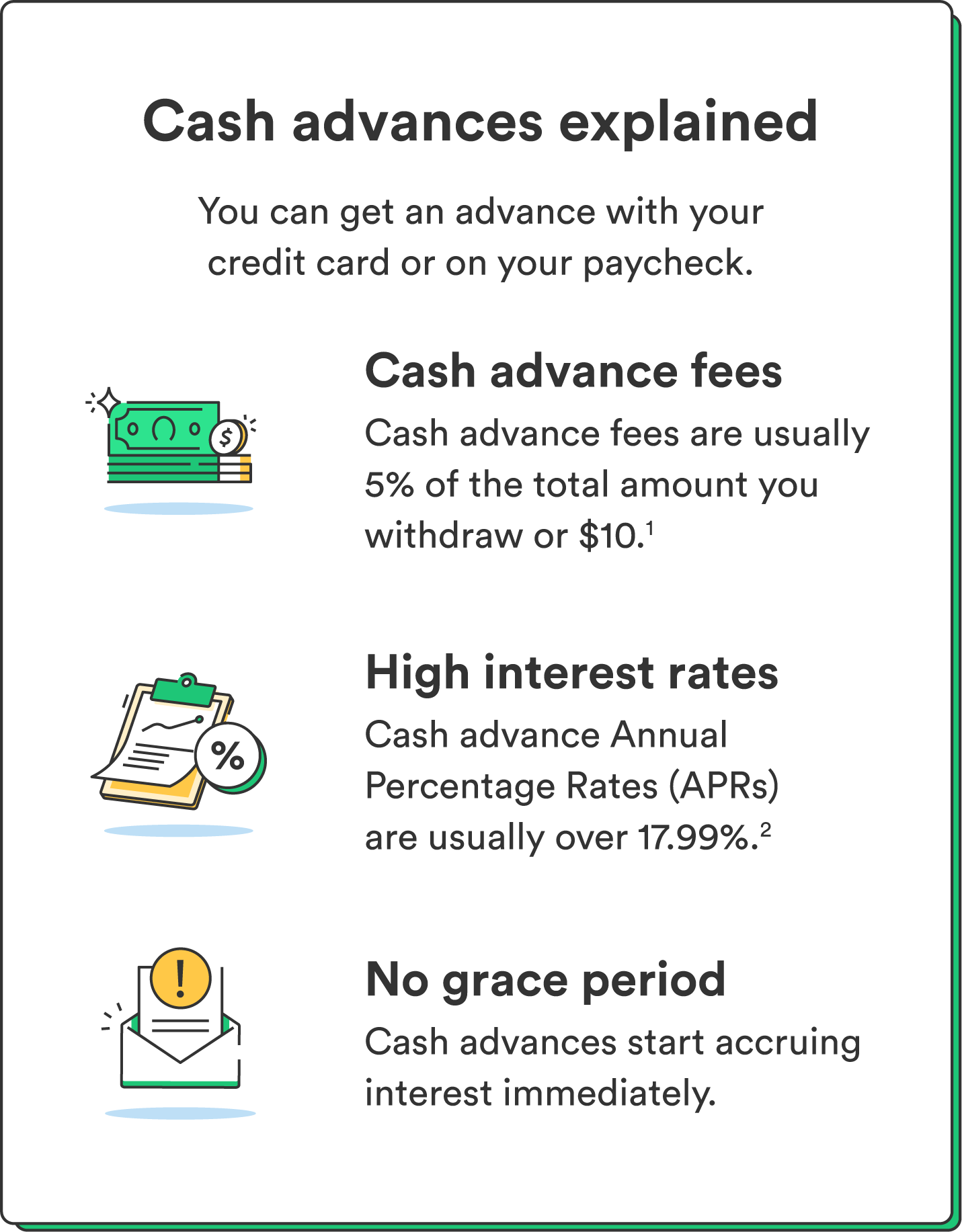

Know All the Terms and Conditions Before Borrowing

One of the most prevalent mistakes borrowers make is not reading the fine print before taking a cash advance. While these loans are easy, they have more interest than the usual credit card purchase.

The following is what you need to be careful about:

- Interest Rates: Unlike the typical credit card transaction, which may enjoy an interest-free period, cash advances will often accrue interest immediately.

- Fees: All credit card issuers have a cash advance fee, typically ranging between 3% and 5% of the borrowed amount.

- Repayment Terms: Cash advances are not as flexible as purchases using a credit card. Late payments attract stiff penalties.

Ensure that you read through all the terms and conditions before you agree to a cash advance. If there is something you do not understand, do not be afraid to ask your provider to explain. You might also need to provide them with some documents, like proof of income, so be ready to make it easy for them.

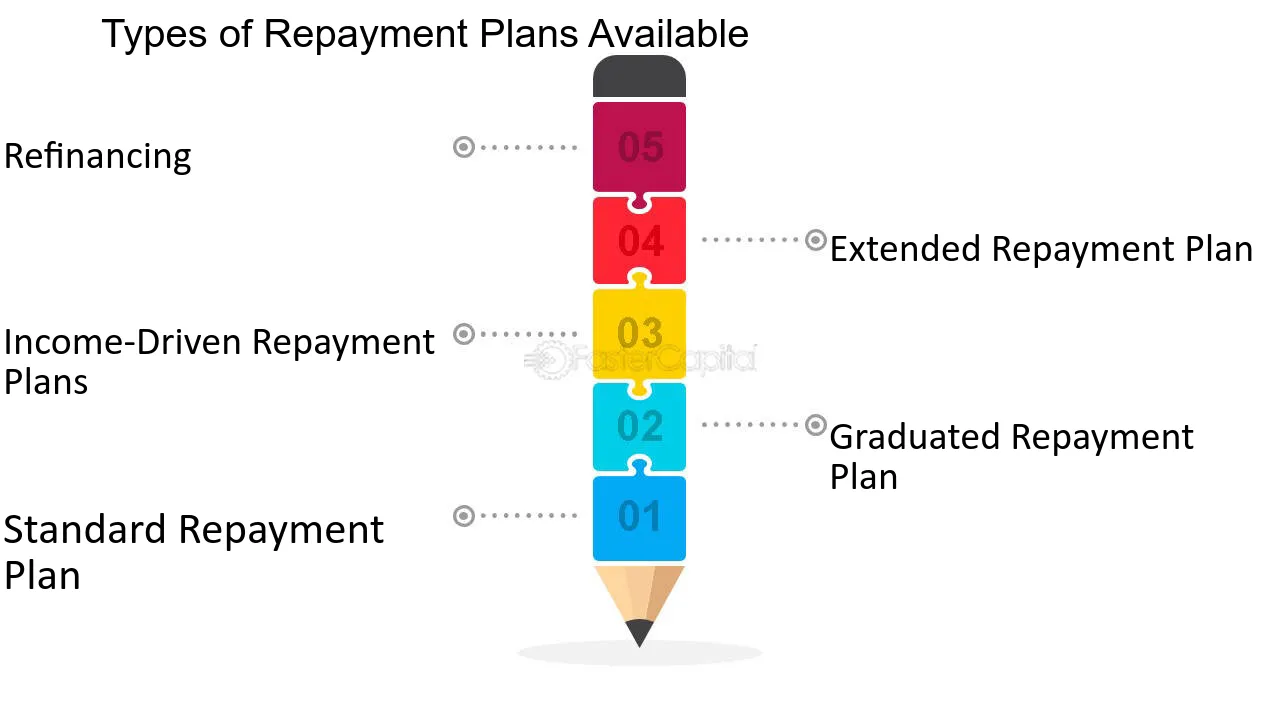

Have Your Repayment Plan Ready in Advance

Like any other loan, a cash advance must be paid back in time. Neglecting this can result in accumulating interest fees and other charges.

Prevent unnecessary financial hardship by setting a repayment plan:

- Establish a Definite Schedule: Decide on how soon you can pay back the loan amount. The faster you pay it, the lower the interest you will have to pay.

- Budget Appropriately: Alter your monthly expenditure so that you can dedicate money towards repayment. Reducing non-essential expenditures can liberate additional cash.

- Make Partial Payments: If you are unable to pay the total amount at once, attempt partial payments to lower the principal and minimize interest charges.

If you are expecting a paycheck or other source of income soon, deposit the amount you will repay in advance to steer clear of late payment charges or debt piles up.

Shop Around Before Selecting a Provider

Not all cash advance providers are created equal. Interest charges, repayment schedules, and customer support can differ dramatically from business to business. That is why shopping around before selecting a provider is essential.

Here is what to look for when shopping around:

- Interest Rates and Fees: Choose lenders with the lowest rates and charges.

- Customer Reviews: Check reviews online so that you know other borrowers’ opinions about the provider.

- Reputation and Legitimacy: Borrow money only from registered and authorized financial institutions to prevent scams or undetectable charges.

Comparing various alternatives saves you from getting the worst deal while eliminating predatory lenders.

Choose the Right Credit Card for Cash Advances

Not all credit cards offer cash advances and the ones that may have different terms and conditions. The type of credit card you possess can make a big difference in the borrowing cost.

The following are some of the considerations when choosing a credit card for cash advances:

- Low or No Balance Cards: Where applicable, use a credit card with no balance so that you do not pay additional interest charges.

- Low Cash Advance Fees: Some credit cards charge less for cash advances than others.

- No Utilization Till Repayment: Do not make other purchases using the same credit card until you have repaid the advance so that you do not accumulate more debt.

Also, do not pull out the full available limit on your card, as this can damage your credit utilization ratio and your credit score.

Final Thoughts

Cash advances are a useful financial resource when utilized sensibly. They offer convenient access to cash in emergencies and can allow you to sidestep penalty fees or late charges on necessary payments. However, they must not be used as an ongoing financial strategy.

Adhering to these five guidelines—responsible spending, knowledge of terms, repayment planning, comparing companies, and selecting the proper card—you can make intelligent choices and steer clear of excessive debt.

If you ever find yourself in a position where a cash advance is required, do it with a clear plan. Take only what you require, pay it back as quickly as possible, and always keep yourself aware of your financial obligations. If used properly, cash advances can be a relief without being a burden.