Most people are aware of the importance of life insurance, and many also have health and extra coverage. But while it’s common to insure the house and car, most people are less familiar with income protection insurance.

An income protection policy is a tax-deductible insurance product designed to replace your income in circumstances where you are not able to work due to illness or injury. It will cover you until you are able to work again, retire, or die, whichever comes first. It is a vital part of an overall risk plan and strategy – no matter what age you are, if you are working and earning an income, income protection is essential for your financial security.

Income protection insurance typically covers 50-85% of your income and pays according to the benefit period and waiting period chosen. A good income protection policy can help you pay for all your expenses and sustain your lifestyle even if you are not able to work.

What Is Income Protection?

Income protection, sometimes referred to as disability income insurance or income replacement insurance, is a type of financial instrument designed to provide a steady income stream if a sickness or injury prevents you from working. It functions as a kind of fallback safety net, enabling you and your loved ones to meet critical financial obligations if your primary source of income is disrupted.

How Income Protection Works?

Even while income protection insurance policy conditions differ, the fundamental idea is usually the same: you pay an insurance provider on a monthly basis, and they replace a portion of your income in the event that an insured illness prevents you from working. The terms of the policy and the coverage you select will determine how much of your income is replaced and how long you keep the benefits.

Types of Income Protection

Income protection is divided into two main categories:

- Short-Term Income Protection: This will pay benefits for a short period, say 6 months to 2 years, and is designed for temporary disabilities or illnesses.

- Long-Term Income Protection: This will supply benefits up to some retirement age if the condition requires it and is best for more serious chronic circumstances.

What Does Income Protection Cover?

Retrenchment

Income protection will cover loss of income after retrenchment. Losing your job suddenly can be very stressful and traumatic. Being unprepared for it will make things more stressful than they need to be. The majority of insurance offers coverage for six months, although some could last up to twelve months. The goal of income protection is to provide a steady stream of income until you find new employment.

Illness or Disability

Unlike disability cover, it does not pay for disease or medical bills related to your disability. It supplies you with an income throughout the period your condition exists or, if the disability is permanent, through retirement.

Why Income Protection Coverage is a Must-Have

Here is why income protection coverage is a must-have for anyone who is working, regardless of age:

Insuring Your Million-Dollar Asset

For most people, their valuable asset is undoubtedly the ability to earn income. Not everyone has huge assets and savings to sustain their standard of living without income.

According to research, average professional after-tax earnings are estimated to be over $3 million from age 25 to 72, which inevitably means income is an extremely valuable asset for people of all ages.

An interesting fact is that the majority of people insure their car, house, and other assets, but significantly fewer people insure their income. Consider this: if an uninsured vehicle is badly damaged, it may take a year to recover financially, but if you lose your income for an extended period, you might never fully recover from such a loss!

Do not Gamble – the Consequences are Huge

While the likelihood of losing the ability to earn an income for a long period seems low, its financial impact is significant. Income protection protects you from this risk.

For example, if you broke your hand and could not work for a month, you could recover financially if you had leave or some savings in hand. But if you became seriously ill or had an accident and couldn’t work for more than a year, then those savings would disappear quickly.

While we do not have to be overly concerned about short-term incapacity, the consequences of long-term capacity can bring an abrupt end to the lifestyle you once took for granted!

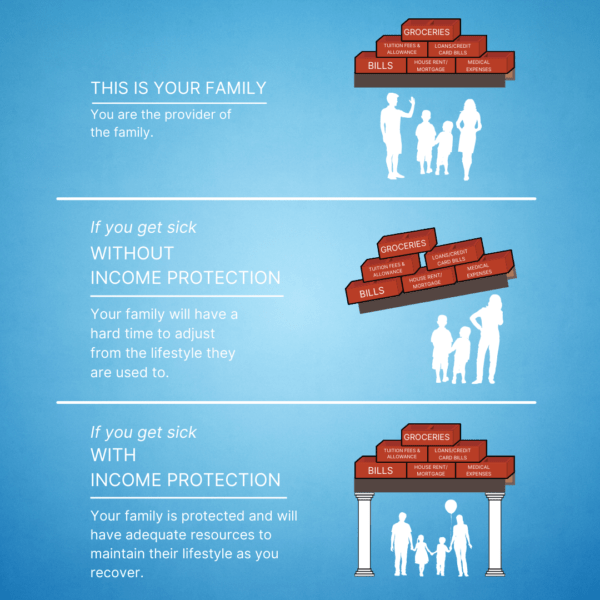

Income Protection Helps You Re-Gain Your Lifestyle

Being unable to work for an extended period can cause severe long-term financial and emotional effects. You may have to sell the family home, change your children’s schools, take out high-interest loans, or even declare bankruptcy.

Are you willing to gamble on your future security? It can take many years to recover from spiraling debt, if ever. By investing in a tax-deductible income protection policy, you are not only ensuring the financial and emotional security of your family but also maximizing the possibility of recovering sooner from both your health and financial issues.

The Case for Early Income Protection

-

Lower Premiums

One of the great reasons to invest in income protection at an early age is the cost. Premiums are much more affordable for young, healthy people. As one age, the likelihood of health issues and other factors that may influence one’s insurability climbs, hence higher premiums.

-

No Pre-existing Condition Worries

Getting income protection early offers an opportunity to achieve this insurance before you experience health conditions. This becomes so important because once health issues arise, the insurers tend to exclude pre-existing issues from coverage later on or charge much higher premiums. This can make your premiums an expensive proposition.

-

Long Term Security

It protects your current life and secures your future life. The longer you start, the longer you will have an extended period of coverage. This will be very helpful, as you never know when accidents or illnesses may strike. One may need a lot of money for the treatment of the disease. Long-term coverage can save one financially.

The Aftermath of Delay

-

Financial Vulnerability

There may be a breach of the insurance contract if the insurer takes an excessively long period to pay up on a legitimate claim. If the contract is not performed within a reasonable timeframe, the policyholder may be entitled to damages from the insurer to put them back in the same situation.

-

Strained Savings

The absence of income protection compels the majority to use savings once they cannot work for an extended period. Most often, this results in them exhausting their savings, which have built up over time, and falling into the abyss.

-

Family Impact

It affects families in the lead because the absence of income creates ripples. The effect is not just on the concerned individual; it also runs through his loved ones. Unstable income can stress relationships and create emotional distress.

When to Avail Income Protection?

You might wonder how long you really need income protection to start. To be honest, this is an essential protective net for everyone who has ever earned money, although, of course, there are specific life situations when its importance is achieved.

Young Families: If you have a young family, you definitely need income protection. You will need coverage for your loved ones if you would not be able to work.

Debt obligations: If the person has serious liabilities such as a mortgage or student loan, income protection covers his various debt obligations in case he is unable to work.

Self-employed people: Income directly relates to one’s ability to work. If one is self-employed, they will face concerns about financial stability if, for some accident or illness, they can not work at all.

Sole Breadwinner: Income protection is very essential for breadwinners. You know that if you are the one on whom your family depends to survive in life, income protection will be their savior in your case.

Conclusion

The purpose of income protection is to provide individuals with a safety net in the event that unanticipated events occur that prevent them from getting paid on a regular basis. By providing financial support, income protection may lessen the burden of debt during difficult times and assist individuals and their families in maintaining their standard of living.